(Bloomberg)

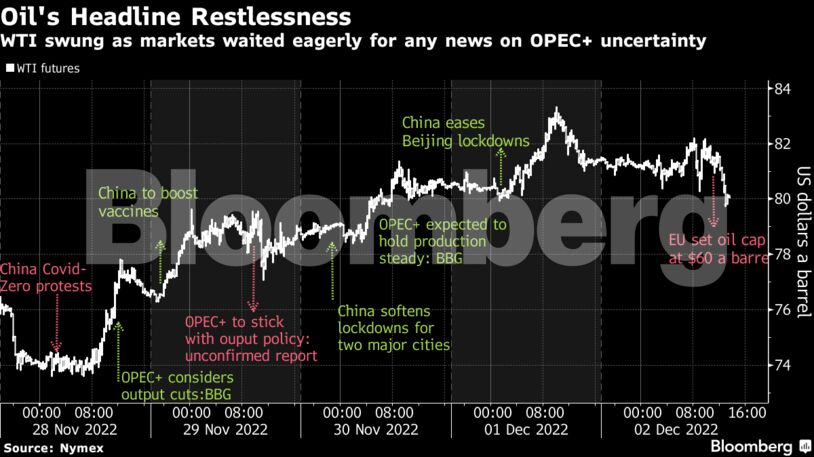

Oil posted its biggest weekly gain in a month, after a volatile week marked by China loosening Covid restrictions and speculation on OPEC+ output policy.

Front-month volatility jumped to 53% earlier this week, the highest since September, with crude trading in a $10 range. Speculation of OPEC+ output cuts sent crude swinging as traders tried to foretell what the cartel might decide over the weekend. Prices got a boost as China, facing extraordinary unrest, began to ease Covid-Zero policies, aiding the outlook for energy consumption.

The gyrations have become too much for many traders to stomach. Open interest for WTI stands at the lowest since 2014 and money managers have slashed bullish bets on both benchmarks for three weeks straight, to the lowest in more than two years. Analysts say the liquidity crisis will continue as positions continue to be closed out before year end.

Oil staged a sharp rebound this week after hitting its lowest level since 2021 on Monday, with demand prospects improving due to the scaling back of China’s Covid policy following protests. The rally was aided by broader market sentiment reacting optimistically to signals from Federal Reserve officials early in the week that the pace of interest-rate hikes will slow.

However, the four-day rally came to a halt Friday after bearish headwinds reasserted themselves into the market. Faster-than-expected US employment growth figures reignited fears that the Federal Reserve will tighten further to slow down growth, while the European Union agreed to a $60 a barrel price cap on Russian oil. The move is intended to allow Russian oil to keep flowing in global markets while limiting financial gains for Putin.

Prices:

- WTI for January delivery rose fell $1.24 to settle at $79.98 a barrel in New York.

- Brent for February settlement fell $1.31 to settle at $85.57 a barrel.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS