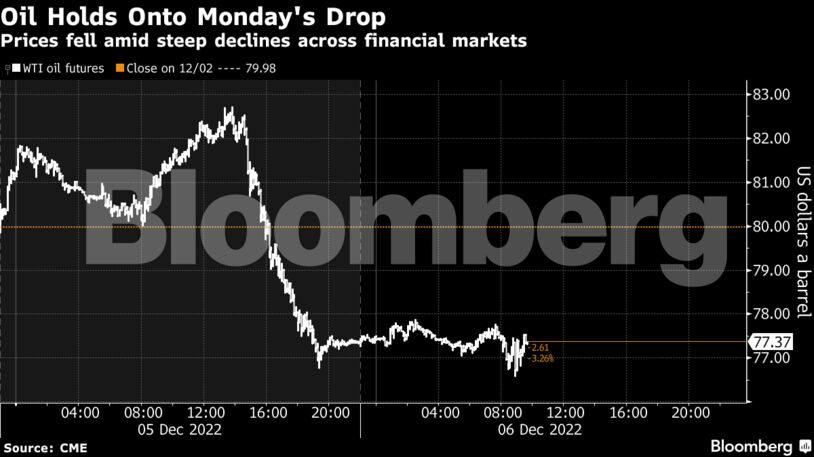

Oil stabilized after Monday’s plunge as signs that China is moving away from its strict Covid Zero policy helped stem losses from a wider market slump.

West Texas Intermediate was little changed near $77 a barrel following a roller-coaster session on Monday, when a broad shift away from risk assets saw prices close down 3.8%. The city of Beijing will scrap Covid testing requirements at public venues following similar moves in other areas, bolstering the outlook for demand in the world’s largest crude importer.

The market is weighing the long-term impact of the latest round of restrictions placed on Russia by the European Union and Group of Seven to punish Moscow for the war in Ukraine. These include limits on insurance and a $60-a-barrel cap on Russian oil. So far, although some ships are stuck near Turkey in part due to the changes, there’s been no widespread disruption.

Monday’s renewed price slide comes against a backdrop of ever-dwindling liquidity in the oil market. Brent open interest is at the lowest level since 2015, with traders paring back positioning in the final month of the year. Such declines can bolster market volatility.

“Global oil demand is likely to remain subdued,” in the first half of next year said Jean-Pierre Durante, head of applied research at Pictet Wealth Management. “The oil market looks set to remain broadly balanced in the short term.”

Prices:

- WTI for January delivery was unchanged at to $76.92 a barrel at 9:59 a.m. in London.

- Brent for February settlement added 0.2% to $82.82 a barrel.

Saudi Arabia, meanwhile, lowered most oil prices for Asia, including for its flagship Arab Light grade, in a sign demand remains fragile. The move was largely in line with refiners’ and traders’ predictions, according to a Bloomberg survey. The price is now at its lowest level since March.

Oil’s time spreads have also continued to weaken, signaling ample near-term supply. WTI’s six-month spread was 40 cents a barrel in contango, a bearish pattern, compared with 64 cents a barrel in the opposite backwardated structure a week ago.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS