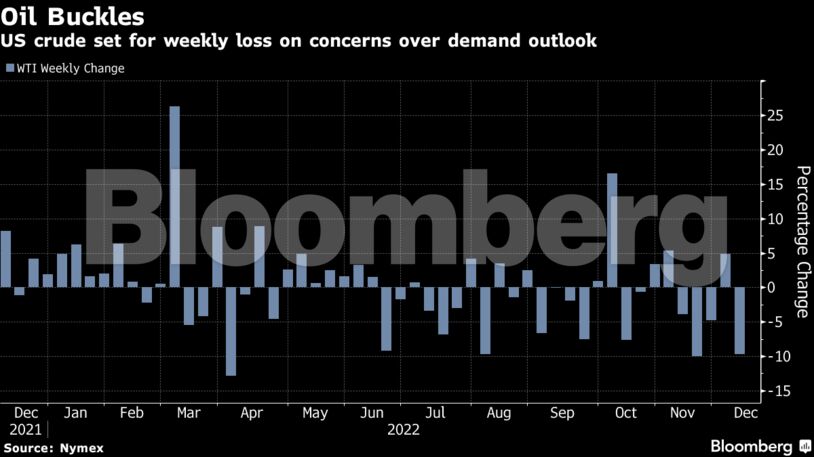

West Texas Intermediate briefly fell below $71 a barrel to the lowest price in a year. The US benchmark — along with Brent crude — has given up all of its gains for the year and slumped 11% this week. Thin trading has exacerbated price fluctuations, with volatility rising again Friday on stronger-than-expected US inflation data.

TC Energy Corp. is planning to restart one leg of the shuttered Keystone oil pipeline beginning Saturday, following a 14,000-barrel crude spill, according to people familiar with the matter. Shell Plc has restored normal operations to a 20-inch segment of the Zydeco crude system after running it at reduced rates since November. Earlier in the week, there were some concerns the Keystone disruptions would put a dent into crude stockpiles in Cushing, Oklahoma, the nation’s largest storage hub.

“Crude can’t find a bid as Keystone looks to come back online in short order,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Management. “For now, every headline is being seen through a bearish lens and buyers are not motivated get involved until they see demand signals improving.”

Friday’s WTI decline comes on the back of a small rally earlier in the day triggered by Russia President Vladimir Putin saying the country may cut production in response to the G-7 cap on the price of its crude.

“Commentary from Russia about cutting production is perceived as tactic to talk up price as opposed to having a meaningful impact on supply,” Babin said.

Crude is now on track for its first back-to-back quarterly decline since mid-2019 on a souring economic outlook as central banks tighten monetary policy, though Treasury Secretary Janet Yellen still sees the US avoiding a recession. Traders are also assessing the fallout from a price cap on Russian oil, which has led to a jam of tankers in Turkish waters due to a standoff over insurance.

Prices:

WTI for January delivery fell 0.6% to close at $71.02 a barrel in New York.

Brent for February settlement slid 5 cents to $76.10 a barrel, after falling as much as 1.4%

The market continues to signal ample near-term supply, with the prompt spread — the difference between the two nearest contracts — for both WTI and Brent holding in contango. The global benchmark was about 47 cents a barrel in contango, compared with $1.44 in backwardation a month earlier.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS