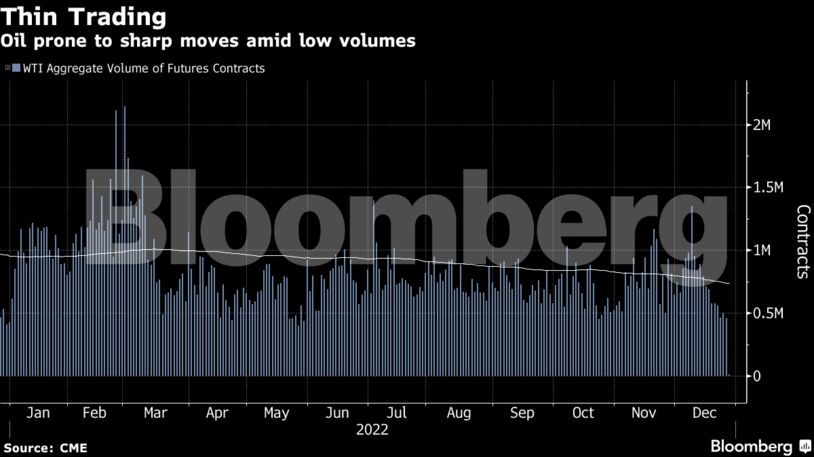

Crude is still set for a modest gain in 2022 after a volatile year that saw prices surge following Russia’s invasion of Ukraine and then gradually pull back as fears of a global slowdown grew. More recently, China’s rapid unwinding of its strict Covid Zero policy and a resulting wave of virus cases have hit a market that’s prone to sharp swings due to a lack of liquidity.

“Most traditional indicators point to a structurally tight oil market, with the wild card that is recession offsetting these factors,” said Keshav Lohiya, founder of consultant Oilytics. “Most of the financial markets have priced in some form of recession, but the big variable is whether the recession will be as big as 2008/09.”

Prices

- WTI for February delivery fell 0.4% to $79.24 a barrel as of 10:15 a.m. London time, after rising as much as 0.5% earlier.

- Brent for February settlement slipped 0.4% to $83.96 a barrel.

In the US, refineries on the Texas Gulf Coast, including the country’s two biggest, started ramping up production after freezing temperatures forced them to halt last week.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS