West Texas Intermediate oil futures briefly jumped to over $75 per barrel while physical crude prices from Western Canada to the Gulf Coast also surged on expectations of tighter supplies following the outage.

Prolonged disruption would significantly tighten the availability of oil in Cushing, Oklahoma, the delivery point for benchmark US futures. Inventories at the hub are already at their lowest since July — and at multi-year lows seasonally — after refineries ramped up processing in response to strong gasoline demand. The disruption comes at the end of a year in which record fuel prices have become a major domestic political issue.

The Keystone system begins in western Canada and runs to Nebraska, where it splits. One branch heads east to Illinois and the other runs south through Oklahoma and onward to America’s refining hub on the Texas Gulf Coast. The line had a capacity of 611,000 barrels-a-day, according to Canada Energy Regulator data published in March.

The spill follows several other leaks to hit Keystone in the past several years. The system was shut in October 2019 after it spilled thousands of barrels of oil in North Dakota.

Traders said they expect the latest outage will likely last a few days since it affects a waterway, which can potentially complicate cleanup efforts. Calgary-based TC didn’t immediately provide an estimate of how much crude leaked or a timeline for a restart.

The Nebraska Department of Environment and Energy confirmed the incident occurred in Kansas. The Pipeline and Hazardous Materials Safety Administration, a federal regulator, said it deployed personnel to the site of an oil leak near Washington, Kansas, on Wednesday.

“PHMSA’s investigation of the cause of the leak is ongoing,” the agency said.

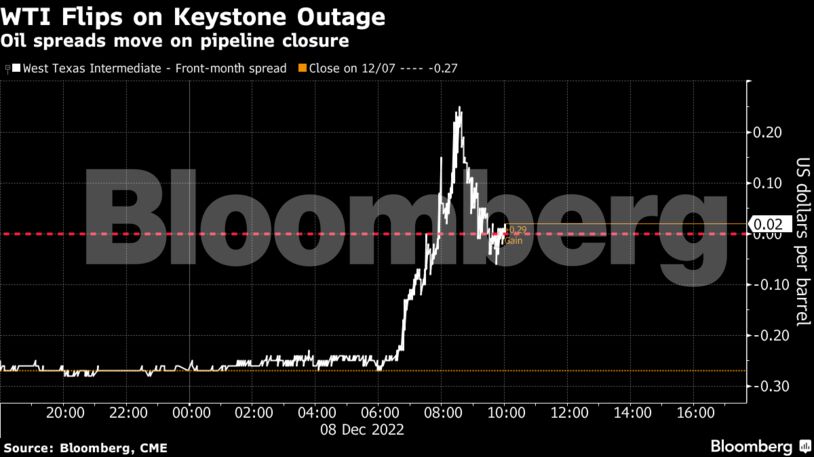

With refinery runs in the Midwest at their strongest since August, the US crude market could now get very tight. WTI rose as much as 4.48% on Nymex before paring gains. It was 0.7% lower at $71.51 at 11:25 a.m. in New York. The nearest time spread for the benchmark surged as much as 42 cents into a bullish backwardation structure, a phenomenon that typically shows there’s concern about supply.

Physical markets in the US Gulf Coast are signaling tightness, too. Gulf Coast sour crude prices have risen in response to the outage. Mars Blend, a medium sour benchmark, strengthened by about 30 cents, according to Link Data Services.

In contrast, heavy crudes such as Western Canadian Select (WCS) in Canada declined by 70 cents a barrel, according to data from Bloomberg, as the outage threatens to back up more Canadian crude in the Hardisty area.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire