Courtesy of ENERGYminute

See more articles and infographics from ENERGYminute HERE

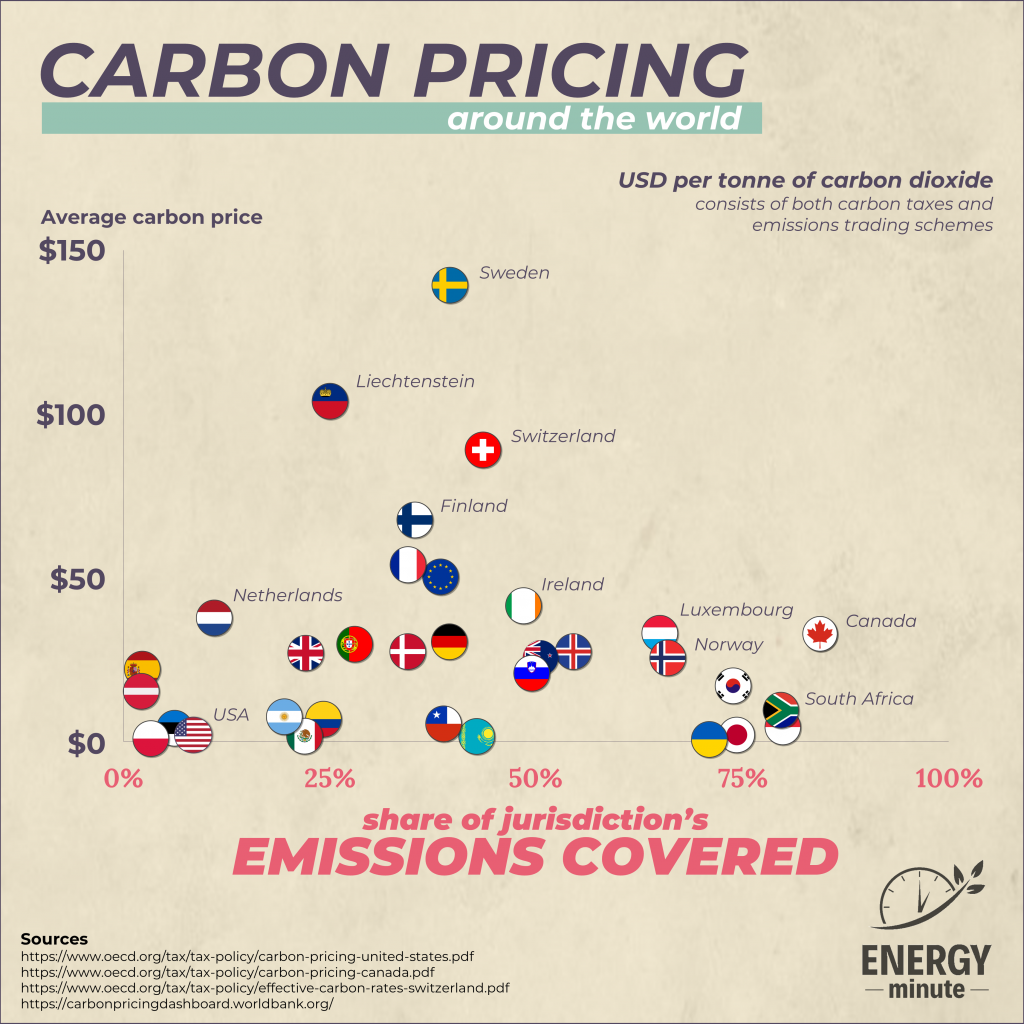

While many countries have adopted carbon pricing schemes, there is still a wide range of coverage and pricing between countries and jurisdictions.

Different types of schemes:

Carbon taxes: Carbon taxes make emitting more expensive by adding a cost to every tonne emitted. It directly adds a cost by defining a tax rate on greenhouse gases.

Emissions trading scheme: Often referred to as a cap-and-trade system, a jurisdiction will set a cap on emission and companies will buy and sell credits to meet emissions goals.

Sources:

https://www.oecd.org/tax/tax-policy/carbon-pricing-united-states.pdf

https://www.oecd.org/tax/tax-policy/carbon-pricing-canada.pdf

https://www.oecd.org/tax/tax-policy/effective-carbon-rates-switzerland.pdf

https://carbonpricingdashboard.worldbank.org/

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS