“There are too many geopolitical risks on the table — that should keep oil’s trajectory higher,” said Ed Moya, senior market analyst at Oanda Corp. “If the dollar continues to slide here, oil’s strength could be relentless.”

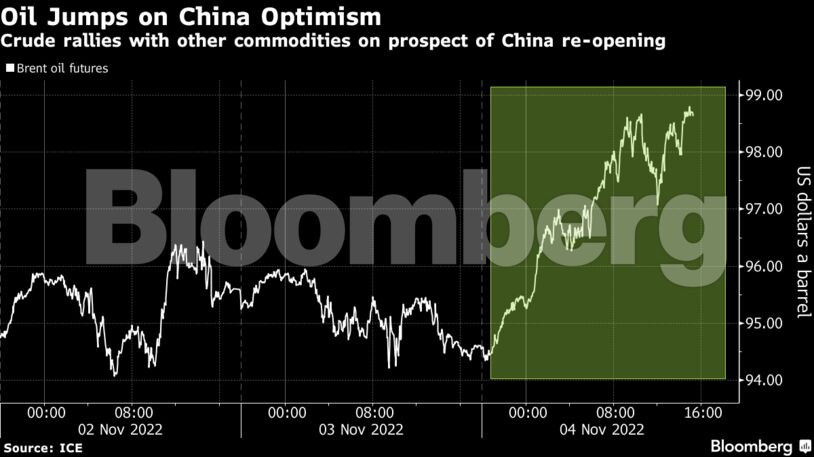

China’s Covid Zero strategy, which relies on lockdowns and mass testing to stamp out infections, has weighed on the nation’s economy and on the crude market. Oil demand in 2022 is seen falling by 400,000 barrels a day due to the virus curbs, according to Bank of China International Ltd. analysts.

Prices:

- WTI for December delivery advanced $4.44 to settle at $92.61 a barrel in New York.

- Brent for January settlement gained $3.90 to $98.57 a barrel.

“With China’s easing some COVID restrictions especially for air travel most traders are taking the news as a positive pull to demand in the near future,” said Dennis Kissler, senior vice president at Bok Financial Securities.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire