The Organization of Petroleum Exporting Countries and its allies including Russia may consider supply cuts when members meet to assess output policy this weekend, potentially deepening curbs agreed the last time members convened in October. The gathering precedes a deadline for European Union curbs on Russian flows as the bloc struggles to agree on a price cap.

Oil has lost about 9% this month as a deteriorating physical market cooled some of the market’s exuberance. Concerns that tighter monetary policy will slow consumption as well as doubts about demand in China prompted OPEC+ to announce a major output cut last month, and delegates from the group now say that additional reductions could be an option.

All the while, the shape of the futures curve has flipped in recent weeks, pointing to a weaker market than previously.

“The structure of the market seemingly justifies a deeper reduction,” by OPEC+, RBC Capital Markets analysts including Helima Croft said in a note to clients. “The same dynamics that OPEC had voiced concerns about nearly two months ago are now visible in the forward curve.”

Prices:

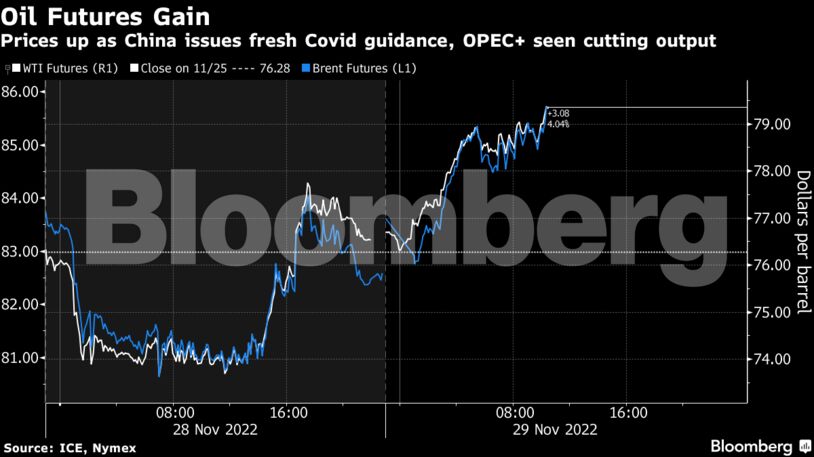

- WTI for January delivery added 2.7% to $79.31 a barrel at 10:29 a.m. in London.

- Prices touched $73.60 on Monday, the lowest since December 2021.

- Brent for January settlement gained 2.9% to $85.62 a barrel on the ICE Futures Europe exchange.

Market watchers are weighing the alliance’s next move. Industry consultant FGE said that the group may decide to reduce output by another 2 million barrels at the Dec. 4 gathering to counter a faltering market, while RBC said it expected either no change to supply or a reduction of as much as to 1 million barrels, depending in part on how prices fared this week.

The weakening at the front of the oil futures curve has been precipitous. On Monday, Brent’s nearest timespread closed at its weakest level since 2020, a sign of oversupply. Until this month it had been in the opposite structure, known as backwardation, all year.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS