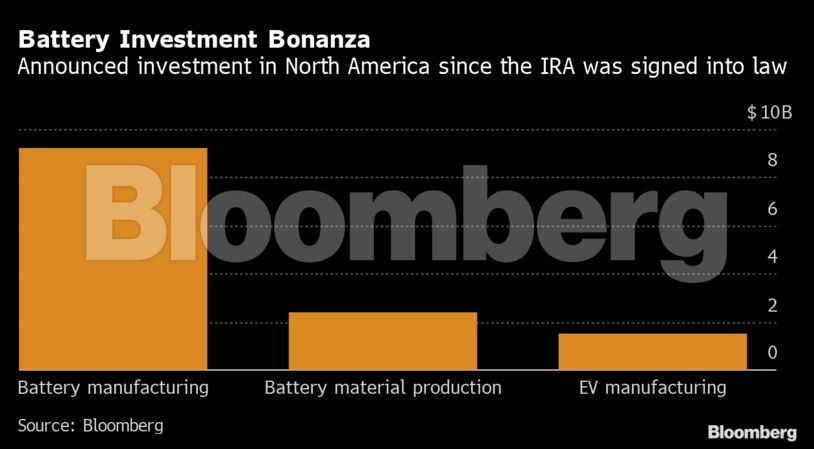

More than $13 billion of investment in battery raw material production and battery and EV manufacturing has been announced in the less than three months since Biden signed the IRA into law on Aug. 16. Volkswagen and Mercedes-Benz almost immediately sealed agreements to secure mining and refining resources from America’s neighbor to the north. Honda and Toyota earmarked almost $7 billion worth of EV battery plant investments within two days of one another. An Australian development company started up the first US cobalt mine in three decades. BMW said it would spend $1.7 billion expanding its South Carolina SUV factory, and that its battery supplier would build a new plant nearby.

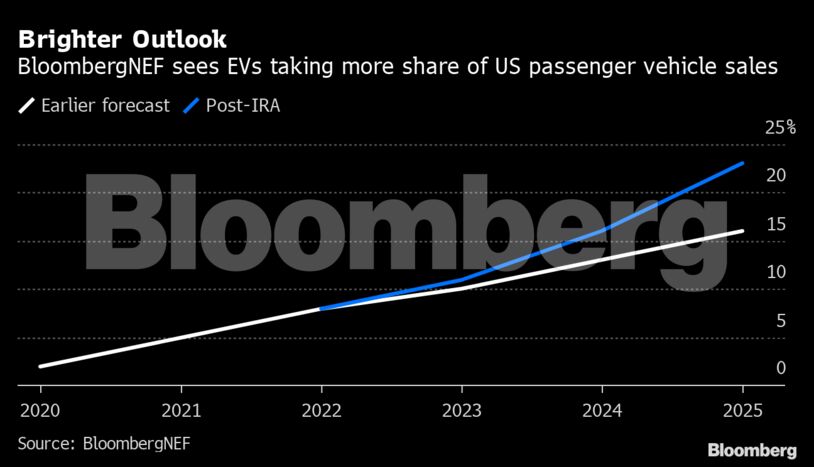

Of course, big investments like these aren’t formulated overnight, and the larger forces of geopolitical risk and broken-down supply chains already were leading automakers to localize more. But the IRA will keep EV investments flowing to the US not just because of the perks awaiting consumers at the point of purchase. The bill also contained a less-talked-about manufacturing tax credit that subsidizes battery cell and pack production. Analysts at UBS believe this support “has the potential to make the US a global EV battery hub.”

The tax credit consists of $35 per kilowatt hour for battery cell assembly, and another $10 per kWh for battery packs. In a report authored by 21 analysts last month, UBS estimated that battery cell prices were hovering around $140 per kWH, meaning the tax credit will cover 25% to 30% of total cell manufacturing costs.

“With that, cell manufacturing in the US could be more profitable than in any other country,” the UBS analysts wrote in their Sept. 20 report. “The US administration obviously considers EV batteries as the oil of the 21st century, and is willing to pay a price for energy independence.”

Ford shed some light late last month on just how much of a boon this will be to the automaker and its battery partners starting next year. It’s expecting the tax credit to total more than $7 billion by 2026, and to step up even further in 2027 as its battery joint venture plants ramp up to full production.

For all the heat Senator Joe Manchin took for scuttling the Build Back Better bill that would have extended EV purchase tax credits in more lenient and generous ways, the battery and raw material sourcing provisions that the West Virginia Democrat insisted on working into the IRA also are good politics for Republicans, who’ve cheered new EV investments in their states. Taxpayers will only subsidize EVs that are assembled in North America, with batteries manufactured in North America, using raw materials sourced from North America. Vehicle price and income caps were put in place

China has warned there will be no winner if the US cuts the country out of the battery supply chain. BMW CEO Oliver Zipse similarly has said that IRA risks leading to a “dangerous” sequence of trade barriers going up that thwarts EV adoption.

Biden’s Treasury Department has an opportunity to alleviate these concerns by giving the industry more clarity before year-end as to how the IRA will be implemented. Regardless of how this shakes out, the amount of investment since the act was signed that’s flowed to red states — Honda’s in Ohio, Toyota’s in North Carolina, BMW’s in South Carolina — will make it politically inexpedient for Republicans to rip it up.

“IRA is a brilliant piece of industrial policy,” said Julia Poliscanova, senior director for vehicles and e-mobility at the Brussels-based non-governmental organization Transport & Environment. “It’s a game-changer for the US as it has unleashed a wave of investment announcements into critical minerals and the battery value chain.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire