Refiner PKN Orlen said deliveries to its Polish refineries had not been disrupted by the outage. Russia’s Transneft said flows to Poland are continuing.

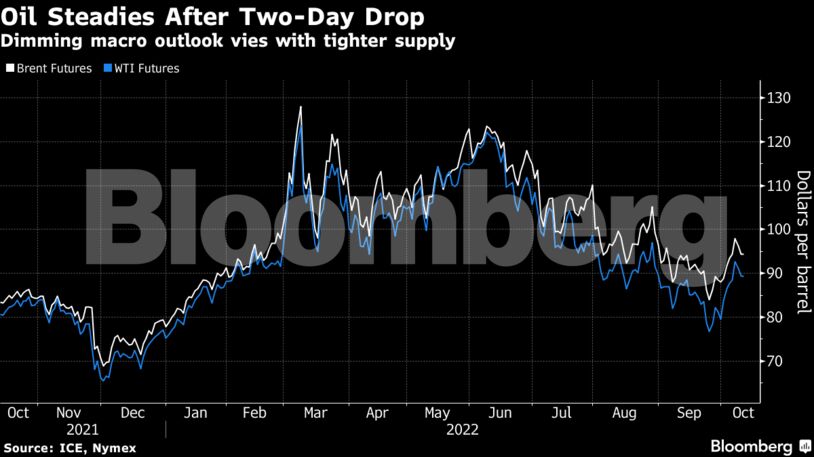

Crude rallied last week after the Organization of Petroleum Exporting Countries and its allies agreed to cut oil supply. Still, focus remains on the health of the global economy as aggressive rounds of interest rate rises dampens the outlook for global growth.

“It feels like the market is underestimating supply risks and focusing on demand concerns,” said Giovanni Staunovo, commodity analyst at UBS Group AG.

Prices:

- WTI for November delivery fell 0.1% to $89.25 a barrel at 8:53 a.m. in London.

- Brent for December settlement edged higher to $94.35 a barrel.

As banks adjusted to the shifting outlook, RBC Capital Markets warned that global benchmark Brent could sink into the low $60s in 2023 in the event of a deep recession. It also outlined two more-benign scenarios, while cautioning that, given the cross-currents, “nailing an oil price is an exercise in futility.”

Investors are in line for a wave of oil market intelligence over the coming days as OPEC, the International Energy Agency, and the US Energy Information Administration all release monthly outlooks. The reports will shed light on demand trends into 2023 and the likely impact of sanctions on Russian crude flows.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS