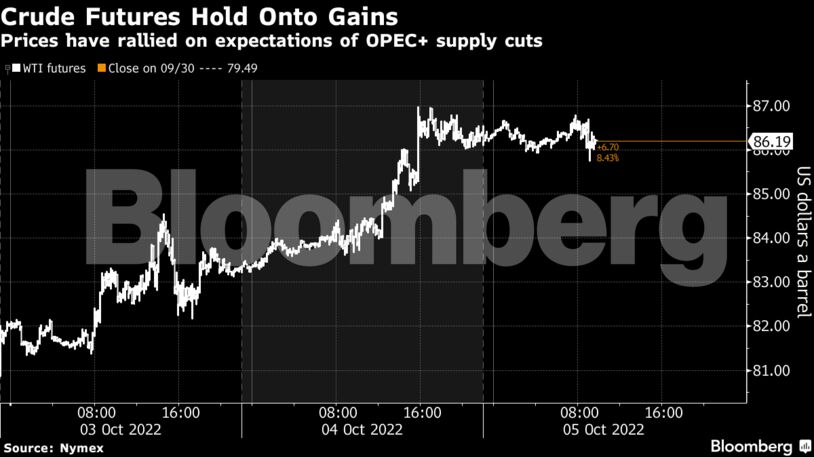

West Texas Intermediate futures traded near $86 a barrel after jumping almost 9% over the previous two sessions. The producer group is set to discuss reducing output by as much as 2 million barrels a day, delegates said before the group meets in Vienna later Wednesday. That’s double the volume previously flagged.

A cut of that magnitude would reflect the scale of concern from the alliance about the outlook for energy demand in the face of rapidly tightening monetary policy. The US benchmark recently capped its first quarterly loss in two years after giving up all the gains made following Russia’s invasion of Ukraine.

There are some conflicting signals however — as the group meets, markets for refined products are surging. Diesel in Europe is in its biggest backwardation since July, indicating tight supply, while gasoline and heating oil in the US have also jumped.

“These are unusual times and this is going to be an unusual cut, this is a signaling cut,” said Bob McNally, founder and president of Rapidan Energy. “The message is: look market we will hold the downside of this price, we will fix this disconnect between paper prices and fundamentals.”

Saudi Arabia may also announce an extra voluntary cut in its own oil output, potentially augmenting a group-wide agreement to curb supply, RBC Capital Markets said in a note. Riyadh has made additional production moves on several occasions since December 2016.

| Prices |

|---|

|

The Organization of Petroleum Exporting Countries and its allies may also discuss a slightly smaller cut of 1.5 million barrels a day, said delegates. Even a reduction of that size is likely to draw criticism from the US and other major oil-consuming nations, which have been battling energy-driven inflation.

“I think we’re setting up for a buy-the-rumor, sell-the-fact situation,” Carley Garner, the founder of DeCarley Trading LLC, said in a Bloomberg TV interview. OPEC+ are “not meeting their quotas as it is already,” she said.

Complicating the supply outlook is a proposed price cap on Russian oil, which a US official said could be announced within weeks. The European Union backed a new package of sanctions that includes support for a price cap on oil sales, people familiar with the matter said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet