(Bloomberg)

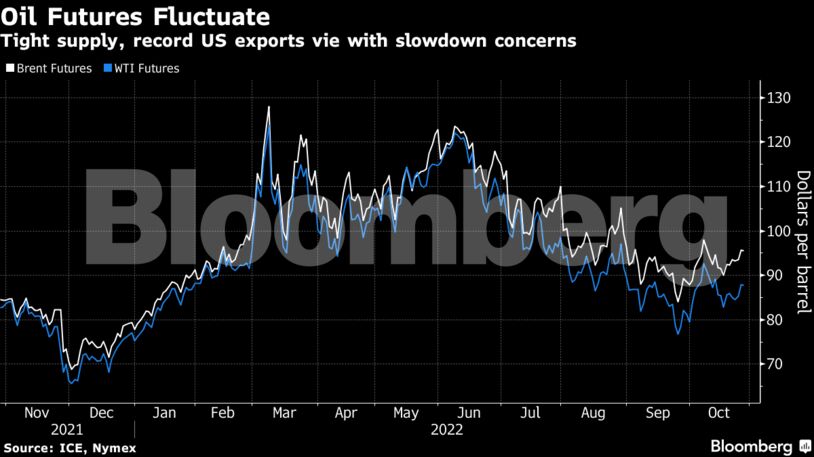

Oil fluctuated after the US reported record exports of crude and fuel, while recent weakness in the dollar made commodities more attractive.

West Texas Intermediate traded in a narrow range near $88 a barrel after gaining almost 4% over the prior two sessions. Total US

petroleum exports hit 11.4 million barrels a day last week, government data showed. The surge came with domestic fuel inventories at historic seasonal lows, highlighting a tightening supply outlook.

The weaker dollar has also helped buoy crude. A Bloomberg gauge of the greenback — which hit a record last month — was little changed Thursday, trading near a three-week low, making raw materials priced in the US currency cheaper for overseas buyers.

After racking up four consecutive monthly losses as concerns about a global slowdown gained traction and central banks raised interest rates, crude has rebounded in October after the Organization of Petroleum Exporting Countries and allies announced a major output cut. Investors have been gauging the likely impact of plans by the European Union and US to punish Moscow further for its invasion of Ukraine with a proposal to cap prices.

US officials have been forced to scale back the price-cap plan ahead of its potential implementation this quarter, according to people familiar with the matter. Instead of strangling the Kremlin’s oil revenues by imposing a strict lid on prices, the US and EU are now likely to settle for a more loosely policed limit that’s imposed at a higher price than once envisioned.

“A weaker US dollar is providing some support to the oil complex, shrugging off at least some concerns over demand uncertainty and higher-than-anticipated OPEC+ output next month as Kazakhstan production is being restored,” Citigroup analysts including Francesco Martoccia wrote in a report.

Prices:

- WTI for December delivery added 0.2% to $88.11 a barrel at 9:20 a.m. in London.

- Brent for December settlement climbed 0.3% to $95.96 a barrel.

Weighing in on Thursday in its World Energy Outlook, the International Energy Agency said the Russian invasion heralded a tipping point for energy markets that, ultimately, will shrink Moscow’s influence and spur a shift to renewables. Russia’s share of world oil and gas markets will halve by 2030, it predicted.

Reflecting this year’s robust crude market Shell Plc and TotalEnergies SE released bumper earnings on Thursday. Earlier, US President Joe Biden said that the profits made by the five largest US oil companies were “not fair.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

What Excites and Worries LNG Exporters in 2026: Maguire