West Texas Intermediate surrendered earlier gains to trade near $85 a barrel. Crude remains within the wide range it has been trading in for the last month, and turned lower on Tuesday as the dollar pared an earlier decline. The US is moving toward releasing further barrels from its strategic oil reserve in order to bolster supply.

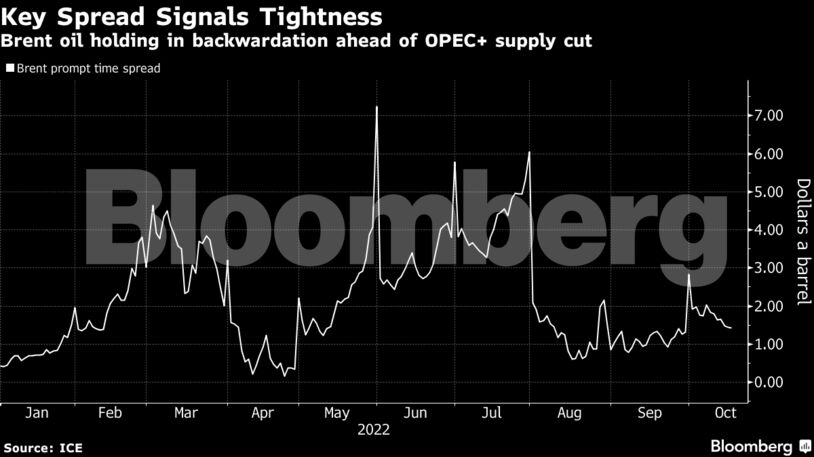

Crude’s choppy trading in October has seen the market caught between two divergent factors. Key time spreads are signaling tightness before OPEC+ output cuts from November, but bearish drivers such weak Chinese demand and aggressive monetary policy from central banks continue to drag on the market.

Prices have fallen by around a third since early June, erasing all the gains made after Russia’s invasion of Ukraine. European Union sanctions on Moscow’s oil trading are set to take effect from December, prompting traders and refiners to book storage tanks in anticipation of a supply crunch.

“Volatility remains high as traders appear more focused on geopolitical and policy risks rather than supply fundamentals,” said Ashley Kelty, an analyst at Panmure Gordon. “Traders continue to contend with a weaker demand outlook yet near term supplies continue to tighten.”

| Prices: |

|---|

|

Despite the rangebound trading, open interest in global benchmark Brent is steadily picking up. Holdings climbed to their highest level since March in the most recent data, though still remain far below where they were before Russia’s invasion of Ukraine sparked huge price volatility and crushed trading volumes. WTI holdings have continued to slump.

China has vowed to stick with its Covid Zero policy, a strategy that has battered its economy and crimped energy consumption. Its decision to delay the publication of key economic data including third-quarter gross domestic product injected a note of caution to trading in the region.

The US is moving toward a release of another 10 million to 15 million barrels of oil from the nation’s emergency stockpile in a bid to balance markets and keep gasoline prices from climbing further, according to people familiar with the matter. Separately, the Biden administration is still weighing limits on exports of fuel, two of the people said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

What Excites and Worries LNG Exporters in 2026: Maguire