The G-7 move is largely symbolic “as the Russians are proving capable of circumventing restrictions already imposed by the G-7 countries, and hitting a record high export volume in August despite sanctions,” analysts at wholesale-fuel distributor TACenergy wrote in a note to clients.

On Friday, prices briefly rebounded after the US State Department said the Iran’s latest response to nuclear-deal proposals was “not constructive.” The talks are being closely watched by oil traders because any deal to relax sanctions could allow more Iranian crude to flow into markets.

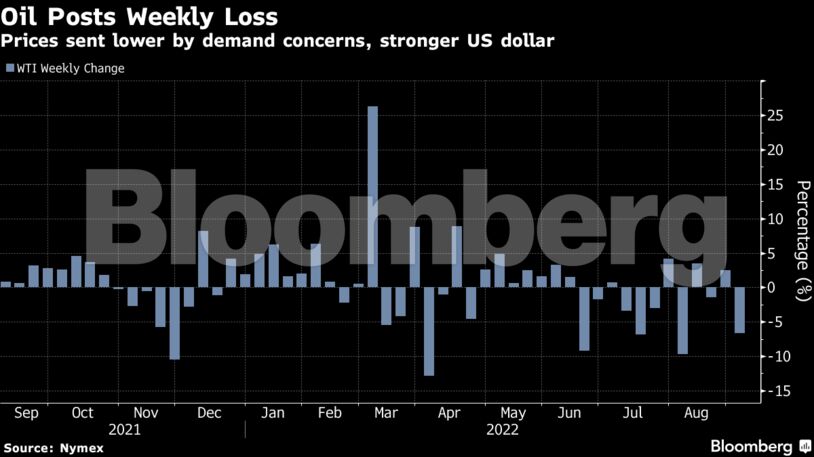

Oil fell by more than 20% in the three months through August, erasing all of the gains since Russia’s late-February invasion of Ukraine.

The price retreat poses a challenge for the Organization of Petroleum Exporting Countries and its allies, with ministers due to meet Monday to plan output policy. While OPEC-watchers expect the group to keep supplies steady, Saudi Arabian Energy Minister Prince Abdulaziz bin Salman raised the possibility of a production cut in remarks last week.

| Prices: |

|---|

|

Widely-watched time spreads, an indicator of market tightness, have been volatile. Brent’s prompt spread — the difference between its nearest two contracts — was $1.21 a barrel in a backwardation, compared with almost $2 a barrel at the end of last week and 63 cents two weeks ago.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS