Oil prices have now plunged almost 40% from their peak earlier this year, hitting revenues for petrostates. Russia, which is having to discount its barrels because of western sanctions, is pushing the Organization of Petroleum Exporters and its allies to cut their collective by 1 million barrels a day when the producer nations meet early next month, Reuters reported Tuesday.

The latest thrust of the market’s retreat has come amid a deteriorating outlook for global growth. The Federal Reserve is on its most-aggressive interest rate hike path in decades in the US, raising fears that central banks are will to allow recessions in order to tame inflation.

“Further OPEC+ production cuts are just one of several factors pointing to tightening oil balances from next month onwards,” said Stephen Brennock, an analyst at brokerage PVM Oil Associates. “Market players should therefore not discount a year-end rally.”

Russia’s war in Ukraine has sparked an energy crisis and weakened economic growth in Europe, undermining demand growth for petroleum.

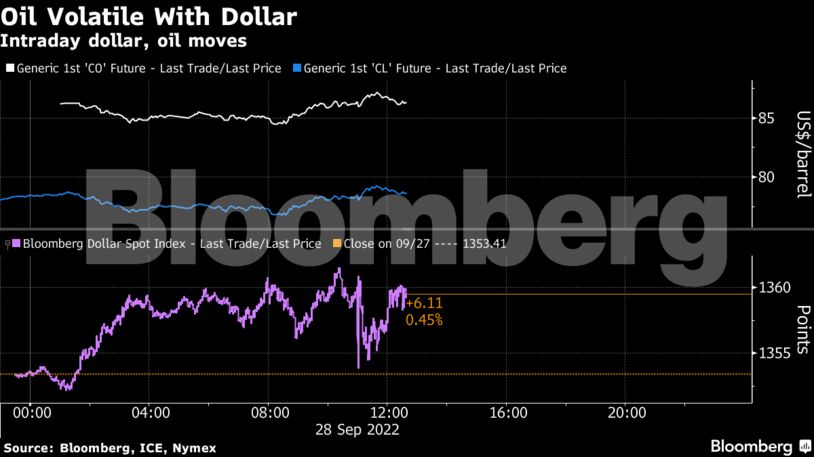

The Bloomberg Dollar Spot Index slumped in mid-morning trading, making commodities more attractive for companies that purchase in other countries. It has subsequently recovered.

WTI was little changed at $78.55 a barrel at 12.33 p.m., having earlier been down as much as 2.5%. Brent was also little changed at $86.44.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS