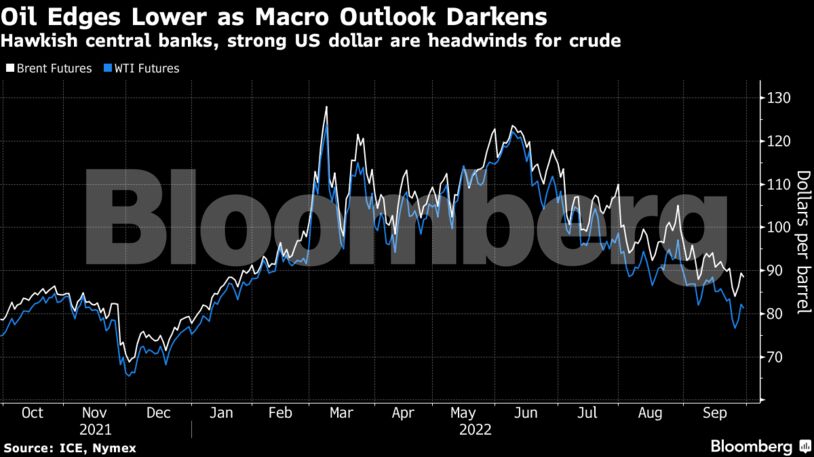

While crude is on track for a weekly gain, futures are still heading for the first quarterly decline in more than two years as fears of a potential recession hang over the market. The dollar has spiked this month and is trading near a record, making commodities priced in the US currency less attractive to investors.

At the same time, however, the market’s structure has firmed in recent days, indicating tighter supplies.

“Headwinds continue and the path will continue to be choppy,” said Keshav Lohiya, founder of consultant Oilytics. “However, backwardation continues to get strong in crude oil and diesel. Either flat price is too cheap or structure is too strong.”

The European Union announced a new round of sanctions against Russia that would ban European companies from shipping the OPEC+ producer’s oil to third countries above an internationally set price cap. Tensions have escalated after natural gas pipelines were damaged in suspected sabotage.

| Prices: |

|---|

|

US crude stockpiles unexpectedly declined last week, while gasoline supplies also fell, according to data from the Energy Information Administration on Wednesday. Inventories at the storage hub at Cushing, Oklahoma, rose.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire