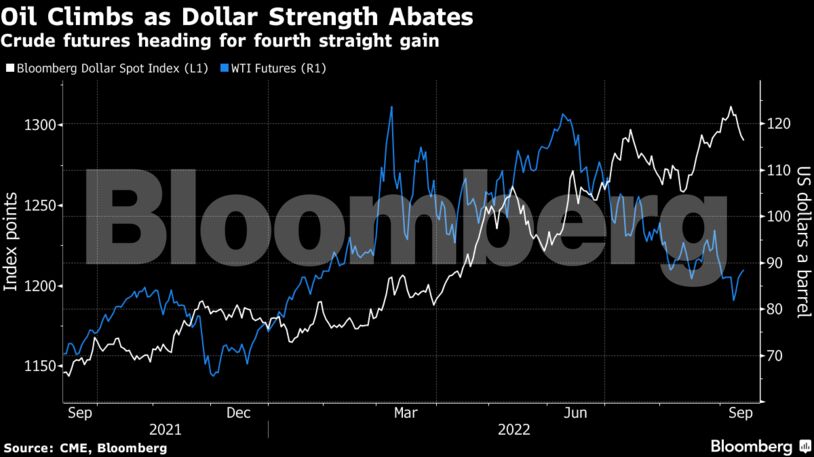

The dollar fell for a third session before US inflation figures due later. Economists expect a decline in the headline figure year-on-year, in part on cheaper gasoline. Nevertheless, traders still expect another large rate hike from the Fed next week, taking their cue from officials supporting that view.

Crude has recovered after hitting the lowest level since January earlier this month as investors fretted about global consumption, including in top importer China, where authorities are pressing on with harsh anti-virus restrictions. Still, after hitting a record last week, the dollar has eased, making commodities cheaper for overseas buyers.

“We do not expect a sustained rally soon, but estimate the risk/reward outlook has improved again,” Morgan Stanley analysts including Martijn Rats and Amy Sergeant said in a note. “The oil market’s structural outlook remains one of tightness, but for now, this is offset by cyclical demand headwinds.”

| Prices: |

|---|

|

Some leading banks have been scaling back their oil price expectations for the rest of this year. Morgan Stanley reduced its Brent price forecasts for this quarter and next, according to a note, following a similar move by UBS Group AG earlier this week.

US Secretary of State Antony Blinken said it was “unlikely” the US and Iran would reach a new nuclear deal anytime soon, echoing recent comments from France, Germany and the UK, and pushing back the likelihood of any substantial increase in Iranian oil shipments in the near term.

Crude investors will get an insight later Tuesday into the near-term market outlook when the Organization of Petroleum Exporting Countries releases its monthly analysis. The producer group and its allies including Russia announced a token supply cut at their meeting last week.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire