Key Developments:

- EU proposes relaxing rules on energy-trading margins

- EU plans to raise $140 billion to cushion cost-of-living crisis…

- …and starts talks with Norway to cut gas prices

- It also wants a mandatory curb on energy demand

- Germany considers nationalizing Uniper

- France warns of a difficult winter

- Gas prices rise

- Europe is seeking to start its own LNG index

- IEA lowers global oil demand outlook

- Here’s a link to the EU’s full plans; details here

(Timestamps in London.)

EU Proposes Easier Collateral Rules (1:30 p.m.)

The Commission has proposed a series of regulatory changes that could help mitigate the liquidity crisis currently ripping through the continent’s energy providers.

Measures include raising the clearing threshold for commodities and other derivatives to €4 billion ($4 billion) and allowing bank guarantees to be accepted as collateral against margin calls, according to the document.

The European Securities and Markets Authority has until Sept. 22 to respond to the proposals, the document states. ESMA said Tuesday it was considering measures to limit stress in the energy market.

France Can Meet Normal Winter Gas Demand (1:15 p.m.)

France can meet gas demand for an average winter, although it could get tight during the coldest days, gas grid operators GRTgaz and Terega SA said in a statement. They urged caution on consumption of the fuel to avoid supply restrictions during the winter.

Germany Confirms Loan Guarantees (12:36 p.m.)

German Finance Minister Christian Lindner confirmed that the government wants to use a fund created to help companies cope with the economic hit from the coronavirus pandemic to provide loan guarantees for struggling energy firms.

Chancellor Olaf Scholz’s cabinet signed off Wednesday on the plan — which will be overseen by state development bank KfW — and the ruling parties will now draw up the required legislation, Lindner told reporters in Berlin.

UK to Unveil Support Package for Businesses (12:25 p.m.)

The UK will set out how it plans to support businesses facing surging energy costs next week, Prime Minister Liz Truss’s spokesman said, adding that the measures would be backdated to Oct. 1 if needed.

The government is still working on details of the package, including whether it will require legislation to implement, spokesman Max Blain said Wednesday. Ministers are also looking at whether the Parliament recess, which is due to start at the close of business on Sept. 22, can be changed to accommodate an announcement, he said.

Commission President Hopes for Deal by Month End (11:39 a.m.)

European Commission President Ursula von der Leyen said she hopes a deal on emergency measures to help rein in the energy crisis will be reached by the end of this month.

Uniper Confirms Germany Mulling Nationalization (11:14 a.m.)

Germany, Fortum Oyj and Uniper are looking at options including a straight equity increase that would result in the German government taking a significant majority stake in Uniper, the utility said in a statement, confirming an earlier Bloomberg report. No decisions have been made beyond what was agreed in a bailout package in July.

Fortum Bonds Rise, Uniper Shares Drop (11:10 a.m.)

Fortum saw its bonds rise and was the best performer in a European index of credit risk following news about the potential nationalization of its German subsidiary Uniper.

The Finnish energy company, which owns a 75% stake in Uniper, went from being the worst performer in the iTraxx Main index of European credit default swaps in early trades to its best performer. Its five-year credit default swap, which is the cost of insuring against a default, was down 14.7 basis points at 275.98, a one-month low.

Fortum’s bonds maturing in February 2026 were similarly up slightly to a cash price of 90.77 cents on the euro, after having dropped earlier in the day on news that the EU is planning to cap revenues for low-cost power producers.

In the stock market, Uniper led utilities lower in Europe. The company’s shares fell as much as 17% to a record low.

Nuclear-Unit Repairs on ‘Good Pace’: EDF

Electricite de France SA is rushing to get its hobbled nuclear reactors back in service by the time winter arrives. “Our target is to have about the same available nuclear output this winter than in the previous winter, when things went well,” EDF Chief Executive Officer Jean-Bernard Levy said at a parliamentary hearing in Paris. Repairs on 10 units affected by so-called stress corrosion cracks are progressing “at a good pace,” he added.

Europe Considers LNG Index (10:10 a.m.)

The European Union plans to work out a price index for imports of liquefied natural gas, said Commission President Ursula von der Leyen. The move could be a way of addressing high gas

costs amid a rift among the bloc’s 27 nations over if and how to impose price caps on imports.

Europe relies on LNG more and more to fill in gaps left by reduced Russian gas, but the current benchmark is based on pipeline supplies and there is no regional price on seaborne imports of the super-chilled fuel.

Germany Sees $10 Billion From Windfall Levy (9:44 a.m.)

Germany could reap around 10 billion euros from the windfall profits from energy companies, according to Finance Minister Christian Lindner. The additional revenue will be used to finance part of a 65 billion-euro relief package unveiled this month to help citizens and companies cope with soaring energy prices.

EU-Norway Talks to Curb Gas Price (9:27 a.m.)

The European Union is in talks with energy powerhouse Norway as part of its efforts to cut the price of gas and tame the damage to its economy caused by lost Russian supplies, according to European Commission’s von der Leyen.

It’s not clear how willing non-EU member Norway will be to cut prices to help its ally. While Prime Minister Jonas Gahr Store said Tuesday that it’s in Norway’s interest to have more stable — and lower — prices, he has also said a European cap would be a bad idea that would end up crimping supply.

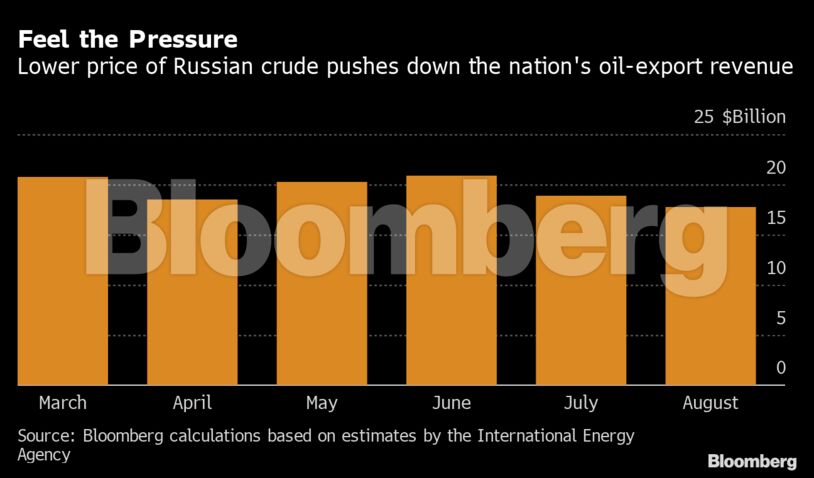

Russia’s Oil Revenue Falls (9:13 a.m.)

Russia’s oil-export revenue contracted to $17.7 billion in August, the lowest since at least March, as a decline in crude prices more than offset higher supplies abroad, according to the International Energy Agency. That’s a drop of $1.2 billion from a month earlier, even as Russia’s daily crude and oil products exports rose by 220,000 barrels to 7.6 million barrels, the IEA estimated.

India Rushes to Buy LNG After Price Dip (9:11 a.m.)

India is rushing to procure liquefied natural gas shipments to take advantage of a recent dip in prices, intensifying global competition for the fuel.

The energy crisis made spot LNG too expensive for Indian buyers for the last several months and exacerbated the South Asian nation’s fuel shortage. Spot prices have now halved since last month’s peak, prompting a scramble by companies — including GAIL India Ltd and Indian Oil Corp. — for shipments for delivery through November, according to traders.

Conservative Group Chief Hits Out at Tardiness (9:05 a.m.)

Manfred Weber, chairman of the European People’s Party, criticized the Commission for being too slow to act on lowering energy prices for consumers and businesses, accusing it of having wasted the summer. He also said that it was not right for Germany to stop producing nuclear energy at a time when it is asking the Netherlands for more solidarity in providing gas.

“Let’s be honest, it was a lost summer,” he said in Parliament. “The markets are obviously

speculating against European solidarity when winter will really be hard.”

France Plans Alerts to Curb Demand (9:00 a.m.)

France’s power-grid operator expects to ask households, businesses and local governments to reduce energy consumption several times over the next six months. The country — traditionally a net exporter of energy — has become a net importer due to issues with its fleet of nuclear plants. In most scenarios, the red “Ecowatt” alert to curb demand would only be issued on a handful of days this winter, grid operator RTE said in a report. It doesn’t expect full blackouts.

Read: France Expects to Issue Alerts to Curb Power Demand This Winter

IEA Trims Oil Demand Estimate (9:00 a.m.)

The IEA trimmed estimates for global oil demand growth this year as renewed Covid lockdowns in China slow activity in the world’s second-biggest consumer.

World oil consumption will increase by 2 million barrels a day this year — about 110,000 a day less than previously forecast — to average 99.7 million barrels a day, the Paris-based agency said in its latest monthly report. Demand will expand again by about the same amount in 2023, it said.

China — the engine of world oil demand growth for much of the past two decades — will see a contraction this year of 420,000 barrels a day in product demand, a much steeper drop than envisaged last month.

Europe Launches $3 Billion Hydrogen Bank (8:56 a.m.)

The EU will create a hydrogen bank to invest 3 billion euros to help scale up the nascent industry producing the clean-burning fuel. Hydrogen made from renewable energy is a key part of the EU’s climate ambitions and shift away from Russian natural gas, but investment has been insufficient to make any meaningful impact.

The European Hydrogen Bank will help guarantee the purchase of hydrogen to create a market for the fuel in the coming years, according to von der Leyen.

Germany Mulls Nationalizing Uniper (8:44 a.m.)

The German government may increase its stake in Uniper SE above 50% and is open to taking the historic step of fully nationalizing the country’s biggest gas importer if necessary to prevent a collapse of the energy system.

Uniper needs more help from the state after already tapping into a support package that could be worth as much as 20 billion euros, according to people familiar with the matter. A surge in gas prices and Russian supply cuts have triggered millions in daily losses, prompting the government to step in with a rescue package in July which gave it a 30% stake.

Europe’s Cost-of-Living Fund (8:23 a.m.)

European Commission President Ursula von der Leyen said the bloc could raise more than 140 billion euros to cushion the cost-of-living blow for consumers by capping revenues from low-cost power producers.

“In our social market economy, profits are good. But in these times it is wrong to receive extraordinary record profits benefiting from war and on the back of consumers.” von der Leyen told the European Parliament on Wednesday.

Gas Prices Steady (8:00 a.m.)

Natural gas prices in Europe were little changed, with traders awaiting the energy intervention plan due to be unveiled by the European Commission. Authorities are designing measures to try to stem the energy crisis.

Von der Leyen said that the EU needs to keep working to lower gas prices.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS