Public E&Ps first mentioned ESG (Environmental, Social, and Governance) in investor presentations and on conference calls in 2017. Many in the industry would argue that environmental protection and standards are in place across the industry due to regulatory compliance at the local, state, and federal levels. Since those early ESG discussions, emissions, water, and land use disclosures have come under scrutiny for oil and natural gas operators.

In 2019, S&P rated the oil & gas industry as second highest in environmental and social risks across thirty industries, second only to metals and mining. Over the last several years, oil & natural gas producers have responded to investor pressure and public climate concerns while balancing energy security issues.

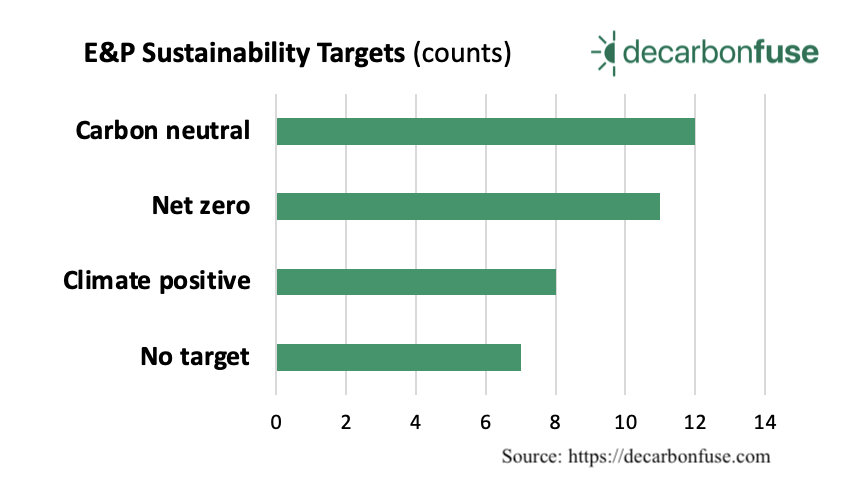

Of the 38 large cap publicly traded E&Ps, 31 or 82% have sustainability targets. The sustainability targets are classified by net-zero, carbon neutral, and climate positive. Only seven E&Ps did not quantify a sustainability target.

Look past the reports and see large investments in clean energy

Public and private E&Ps continue to focus on cash flow returns for their shareholders as a primary driver of new investment activity; yet ESG along with safety remain top priorities. After all, flaring and leaks are lost revenue for most producers. Like other industries, oil and natural gas operators are seeking to lower the carbon intensity of their products. Each company is making bets on reducing emissions through new technology, carbon capture, hydrogen, renewable natural gas, electrification, or other operational solutions.

Several E&Ps are taking an aggressive stance to developing low-carbon and cleaner energy:

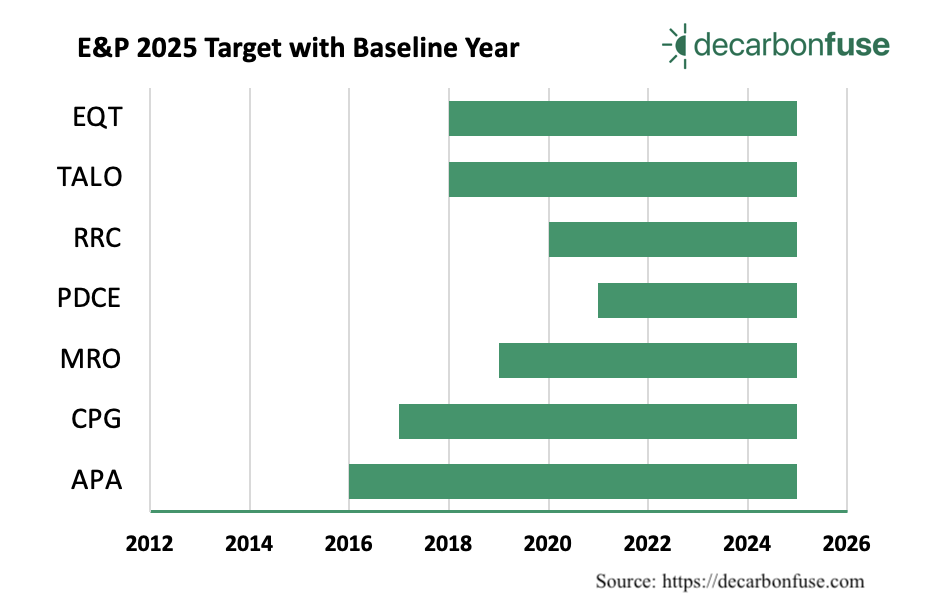

- 18% of the E&Ps have quantified targets set for 2025

- 52% of the E&Ps have reduction targets by 2030

- 63% of the E&Ps are targeting reductions by 2045

EQT Resources (NYSE: EQT) is leading the conversation for LNG and clean natural gas. Along with other industrial partners US Steel, GE, and Mitsibuishi Power, EQT announced a CCS/hydrogen hub for the Northern Appalachian Region in the United States. EQT also publicly supported the Federal Methane Rule and implemented a $75 million capital program aimed at ESG initiatives.

Talos Energy (NYSE: TALO) was the winning bidder for the Texas General Land Offic’s (GLO) carbon storage lease located in offshore state waters. Talos is partnering with Carbonvert and Chevron to develop the offshore sequestration site, known as Bayou Bend CCS. According to the companies, Bayou Bend CCS is strategically positioned to capture more than 35 Mtpa of CO2 emissions in the Port Arthur region. Talos is developing other carbon capture opportunities at River Bend CCS in Louisiana and Coastal Bend CCS at the Port of Corpus Christi.

PDC Energy (NYSE: PDCE) operates in the DJ Basin with plans to reduce GHG intensity by 60% before 2025 and 74% by 2030. Emissions, water, and land use are critical to the environmental component of ESG with safety underpinning the company’s activities. PDCE plans to invest about $100 million to improve the company’s environmental performance. The company is collaborating with Colorado’s regulatory body to develop a comprehensive area plan for their assets. PDCE has a robust community partnership program that includes local schools, programs, and universities in Colorado and West Texas.

Take note of the sustainability actions and investments of the large cap E&Ps. These companies, along with other public and private E&Ps, are delivering the oil and natural gas that is needed today while reducing CO2 and other GHG from their operations. Significant industrial decarbonization is taking place as these companies execute on their carbon capture, hydrogen, and clean energy solutions.

Find company sustainability targets data and the actions those firms are taking through low-carbon and clean energy investments.

List of Companies

- CNX Resources

- Civitas Resources

- Diamondback Energy

- Antero Resources

- APA Corporation

- Crescent Point Energy

- Marathon Oil Corp

- PDC Energy Inc

- Range Resources Corp

- Talos Energy Inc.

- EQT Resources

- ConocoPhillips

- Denbury Resources

- Devon Energy

- Kosmos Energy Ltd

- Murphy Oil Corp.

- Ovintiv Inc

- Pioneer Natural Resources Co

- PDC Energy Inc

- SM Energy Co

- Cenovus Energy Inc.

- Chesapeake Energy

- EOG Resources

- California Resources Corp.

- Cenovus Energy Inc.

- ConocoPhillips

- Devon Energy

- Exterran Corp

- National Fuel Gas

- Pioneer Natural Resources Co

- Suncor Energy Inc.

- Coterra Energy

- Comstock Resources Inc

- Continental Resources, Inc

- W&T Offshore, Inc

- Southwestern Energy

- Magnolia Oil & Gas Corp

- Chord Energy

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein