Oil headed for the biggest weekly decline since early April on increasing evidence that a global economic slowdown is curbing demand, with prices near the lowest level in six months.

West Texas Intermediate were little changed below $89 a barrel on Friday, and was about 10% lower for the week. US gasoline consumption has softened while crude stockpiles have increased. Supply from Libya has picked up, helping shrink key oil futures time-spreads and ease the tightness in the market.

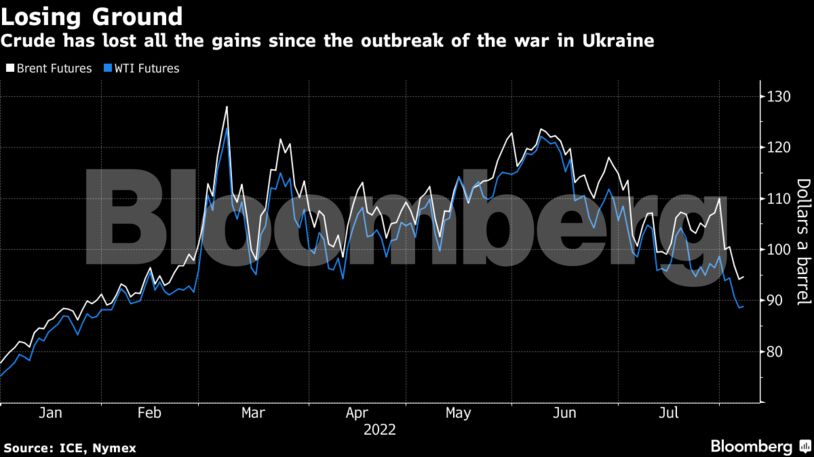

After surging in the first five months of the year, crude’s rally has been thrown into reverse, with losses deepening this month after declines in June and July. The selloff, which has wiped out gains triggered by Russia’s invasion of Ukraine, will ease the inflationary pressures coursing through the global economy that have spurred central banks including the US Federal Reserve to hike rates.

This week’s drop “has started to cause panic in many who were previously dedicated oil bulls,” said Keshav Lohiya, founder of consultant Oilytics. “Some market participants have started to price in the possibility of contango entering the market with the recent selloff, despite a relatively strong healthy physical market.”

| Prices: |

|---|

|

Still, there were some signs of bullishness with Saudi Arabia this week boosting its prices, and OPEC+ warning of scant spare capacity. Saudi Aramco increased its Arab Light grade for next month’s shipments to Asian refineries to a record $9.80 a barrel above the Middle Eastern benchmark. Traders and refiners had expected an even bigger jump.

The shift to much tighter monetary policy has stoked concern among investors that growth will slow, imperiling the outlook for energy usage. The Bank of England warned that the UK is heading for more than a year of recession as it raised borrowing costs, while in the US, a procession of Federal Reserve speakers pledged to continue an aggressive fight to cool inflation.

China has also shown signs of weakness, clouding the outlook for crude consumption in the top importer. Recent data showed factory activity shrank, while China Beige Book International warned the economy was deteriorating.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS