West Texas Intermediate was little changed near $91 a barrel, after sinking 4% on Wednesday. In the US, government data showed Americans are driving less than they did in the summer of 2020, when pandemic travel curbs all but halted movement. Nationwide crude stockpiles also expanded last week.

Ahead of the US data release, the Organization of Petroleum Exporting Countries and its allies including Russia agreed on Wednesday to boost supply by a meager 100,000 barrels a day in September. The group also issued a stark warning on “severely limited” spare capacity.

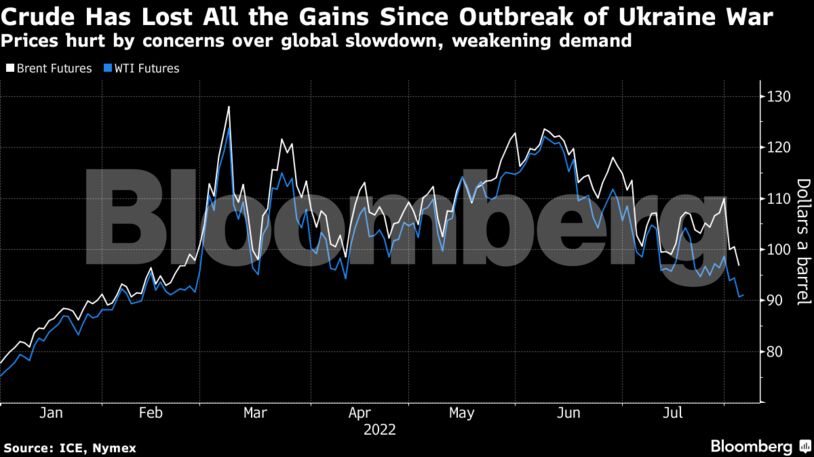

Crude has now given up all of the gains triggered by Moscow’s invasion of Ukraine in February. Since peaking at more than $130 a barrel in March, the US benchmark has been dragged lower by signs that Russia is still getting its cargoes onto the global market, and escalating investor concerns that a global slowdown will erode energy consumption.

“Whether the next $20/bbl move will take prices to $80/bbl or back up to $120/bbl does not depend on the present strategy of OPEC+,” said Tamas Varga, an analyst at brokerage PVM Oil Associates. “It will be the function of demand destruction caused by inflationary pressure and the consequent hikes in interest rates and on Russia’s attitude towards using energy as a weapon in its war against Ukraine and the western world.”

| Prices: |

|---|

|

The extremely modest output increase from OPEC+ came despite a visit by Joe Biden to Saudi Arabia last month, when the US president urged producers to add supplies as part of his efforts to rein in inflation. Still, his administration can take heart from the steady retreat in average retail gasoline prices, which have dropped by almost $1 a gallon since hitting a record in mid-June.

Although the oil market remains in backwardation — a bullish pattern marked by near-term prices trading above longer-dated ones — key differentials have narrowed, signaling that underlying physical tightness is easing off. WTI’s nearest backwardation fell below $1 a barrel this week for the first time since April.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS