West Texas Intermediate climbed 1.1% to over $89 a barrel, while Brent jumped by 1.4% to almost $95. Oil’s main contracts have both traded in a narrow range for the past few days, though futures are still on track for a weekly loss as fears over a downturn and the potential for more supply from Iran continue to hang over the market.

“Liquidity is really poor at the moment so everything is just a lot more volatile — it’s so choppy,” said Sam Culham, an oil broker at GFI Group in London.

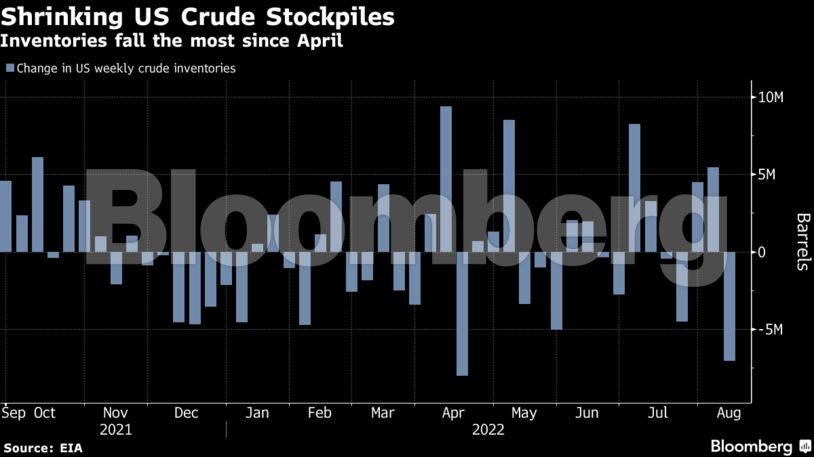

A bullish Energy Information Administration report offset some of the gloom over a potential recession. US crude stockpiles sank by 7.06 million barrels last week, exports rose to a record and gasoline demand climbed to the highest this year.

Crude is trading near the lowest level in more than six months after giving up the gains made since Russia’s invasion of Ukraine, with time spreads signaling market tightness is easing. Still, OPEC’s new Secretary-General Haitham Al Ghais said spare production capacity was “becoming scarce,” adding that he was confident demand will increase this year.

“The market appears to be slightly too bearish on the demand side,” said Daniel Hynes, senior commodity analyst at Australia & New Zealand Banking Group Ltd. “While we may see demand fall back on a seasonal basis, things are looking much tighter in the fourth quarter.”

| Prices: |

|---|

|

US crude exports reached 5 million barrels a day last week, surpassing a high set barely a month ago, EIA data show. The four-week average of gasoline supplied — a proxy for demand — rose to about 9.1 million barrels a day, coinciding with the longest streak of declines in pump prices since 2018.

While the market is backwardated — a bullish pattern marked by near-term prices commanding a premium to later-dated ones — the gap has narrowed significantly. Brent’s prompt spread was 61 cents in backwardation, compared with $2.08 at the start the month.

Prices are fluctuating partially because of declining market liquidity; aggregate open interest over WTI contracts yesterday was the lowest since January 2015 at 1.54 million contracts.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet