Oil fell at the start of the week with investors weighing the prospect for more Iranian supply as the outlook for economic growth weakens.

Brent futures lost as much as 2.3% and were trading near $95 a barrel. President Joe Biden spoke Sunday with leaders from France, Germany and the UK about reviving a nuclear deal with Iran, which could lead to returning supply from the OPEC producer.

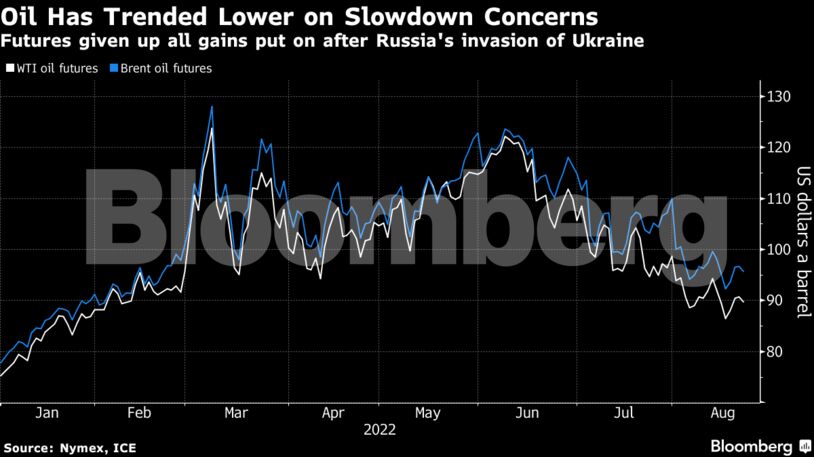

Crude has given up all of the gains since Russia’s invasion of Ukraine in late February as fears over an economic downturn filtered through the oil market. Time spreads are signaling easing concerns over tight supply, while a stronger dollar has also added to headwinds for commodities.

Biden and his European allies discussed “ongoing negotiations” toward a nuclear agreement, including “the need to strengthen support for partners in the Middle East region,” according to a US summary of the call released Sunday. Iran submitted its response on Aug. 15 to a framework circulated by the EU for a deal, which the EU took as constructive.

“We are in a macro economic deteriorating situation with rising interest rates, droughts, China Covid-constraints, and an ugly energy crisis in Europe,” said Bjarne Schieldrop, chief commodities analyst at SEB AB, adding that the oil market appears to be putting a high probability on the chances of a resumption of the Iran nuclear deal.

While there are bearish risks from the potential return of Iranian supply, production in Kazakhstan continues to face disruption. Crude loadings are continuing at only one of the three moorings of the Caspian Pipeline Consortium terminal, meaning client requests are being fulfilled in reduced volumes.

| Prices: |

|---|

|

Rising flows of long-haul cargoes into Asia from regions such as the US, which take twice as long as Middle Eastern barrels to reach buyers, have forced spot premiums of Persian Gulf barrels to dip in this month’s trading cycle. Meanwhile options markets have been pricing growing premiums for bearish put contracts that would profit a buyer if prices fall.

China’s Sichuan province extended industrial power cuts and activated its highest emergency response on Sunday to deal with “extremely outstanding” electricity supply deficiencies, adding to manufacturers’ woes as factories are shuttered and adding to fears of further economic weakness.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire