Aug 12, 2022

(Bloomberg)

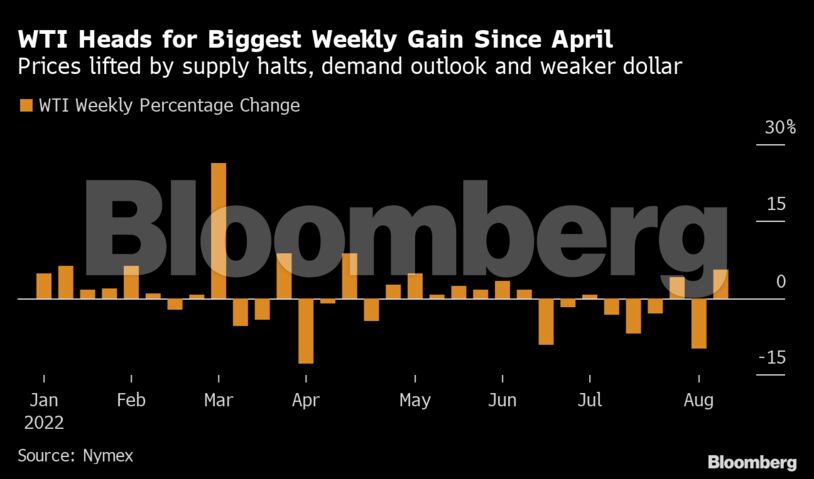

Oil headed for the biggest weekly gain in about four months on interruptions to supply and speculation fuel switching will buoy demand.

West Texas Intermediate traded near $94 a barrel, up by more than 5% this week. Six oil and gas fields in the Gulf of Mexico were shut after a leak at a Louisiana booster station halted two pipelines. The conduits are expected to resume service on Friday, according to Shell Plc.

The International Energy Agency boosted its forecast for global demand growth as soaring natural gas prices and heat waves spur demand. The agency saw consumption 380,000 barrels a day higher than its previous forecast. Wider markets have been on a firmer footing this week after US inflation figures missed expectations, potentially cooling the pace of interest rate hikes by the Federal Reserve.

“The mood has been upbeat in the last few days,” said Tamas Varga, an analyst at PVM Oil Associates Ltd. “It appears that oil is attached to equities, and that it will follow the sentiment in the stock market in the immediate future.”

| Prices: |

|---|

|

Though prices have rallied this week, options markets are telling a different story. There traders are paying the biggest premium for bearish put options over bullish calls since February. That gauge — known as the put skew — has grown steadily since concerns about the strength of the global economy have intensified.

In contrast to the view from the IEA, the Organization of Petroleum Exporting Countries struck a more pessimistic tone. The global oil market is expected to tip into a surplus this quarter, the group said in its monthly outlook on Thursday, trimming its forecasts for the amount of crude it will need to pump.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet