Aug 11, 2022

(Bloomberg)

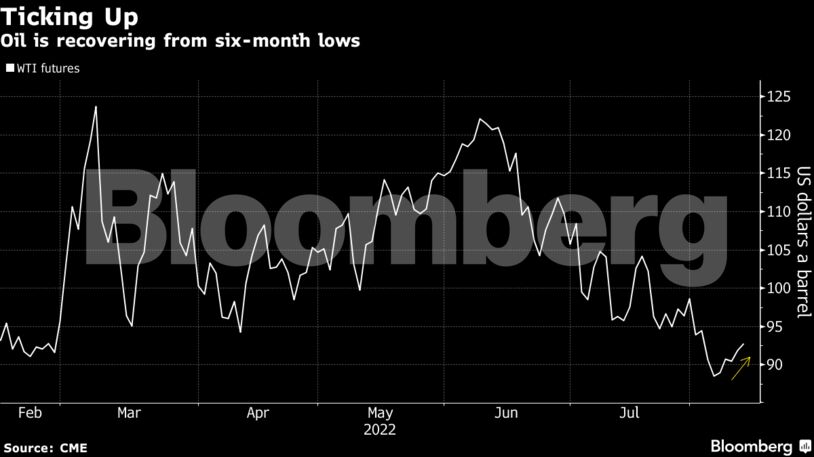

Oil edged higher after the International Energy Agency boosted its forecast for global demand growth this year.

West Texas Intermediate rose 0.9% to trade above $92 a barrel, after earlier slipping by 0.8%. The IEA lifted its consumption estimate by 380,000 barrels a day, saying soaring natural gas prices and heat waves are prompting industry and power generators to switch their fuel to oil.

Crude has been buffeted by bullish and bearish headlines in recent days, while staying largely rangebound near a six-month low. A brief halt of Russian flows to some parts of Europe and weaker-than-expected US inflation data pushed prices higher. The subsequent resumption of Russian supply — as well as renewed attempts to resurrect the Iran nuclear deal — have since weighed on the market.

In the short-term, oil prices will be “dictated by macro, inflation, interest rates and what happens with the Iran nuclear deal,” said Helge Andre Martinsen, a senior oil analyst at DNB Bank ASA. Further out, “it looks like demand worries might be a bit overdone, and extremely high gas prices will support oil demand during winter with gas-to-oil switching.”

| Prices: |

|---|

|

The softer-than-expected US inflation print on Wednesday was driven in part by a marked decline in gasoline prices. Nationwide average retail pump prices have dropped back below $4 a gallon after peaking at a record above $5 in mid-June, according to data from auto club AAA.

The market’s recent easing is evident in a narrowing of closely watched time differentials. WTI’s prompt spread — the gap between its two nearest contracts — has shrunk to 72 cents a barrel in backwardation, down from $2.88 a month ago. The comparable measure for global benchmark Brent was at $1.08 a barrel, down by about two-thirds in the same period.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet