The company will repurchase a further $6 billion of shares in the third quarter, having already bought back $8.5 billion of stock in the first half of the year. It’s the latest sign of how Russia’s invasion of Ukraine has delivered a windfall for investors in major energy producers, even as the soaring costs of fuel batters the economy and threatens a cost-of-living crisis.

Almost every major European oil company to report second-quarter earnings so far, from Norway’s Equinor ASA to France’s TotalEnergies SE and Spain’s Repsol SA, has boosted share buybacks as their profits surged.

“With volatile energy markets and the ongoing need for action to tackle climate change, 2022 continues to present huge challenges for consumers, governments, and companies alike,” Chief Executive Officer Ben van Beurden said in a statement on Thursday.

Shell shares rose 1.8% to 2,154.5 pence as of 8 a.m. in London.

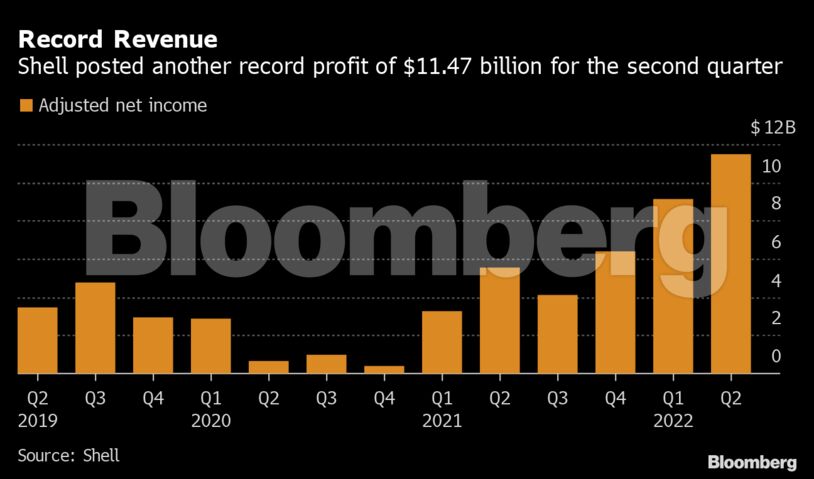

Shell’s second-quarter adjusted net income was $11.47 billion, up from $9.13 billion in the first three months of the year, which at the time was the company’s highest-ever earnings. That exceeded the average analyst estimate of $11.22 billion.

The increase in buybacks comes after Shell signaled in May it would increase distributions to investors by more than 30% of cash flow from operations, its previous ceiling for returns. The company maintained its dividend at 25 cents a share.

“The buyback uplift signals confidence in Shell’s cash flow from operations outlook into 2023,” JPMorgan Chase & Co. analyst Christyan Malek said in a note. While the lack of a dividend increase could weigh on shares today, the accelerated repurchase program “further enhances the scope for future dividend-per-share upside.”

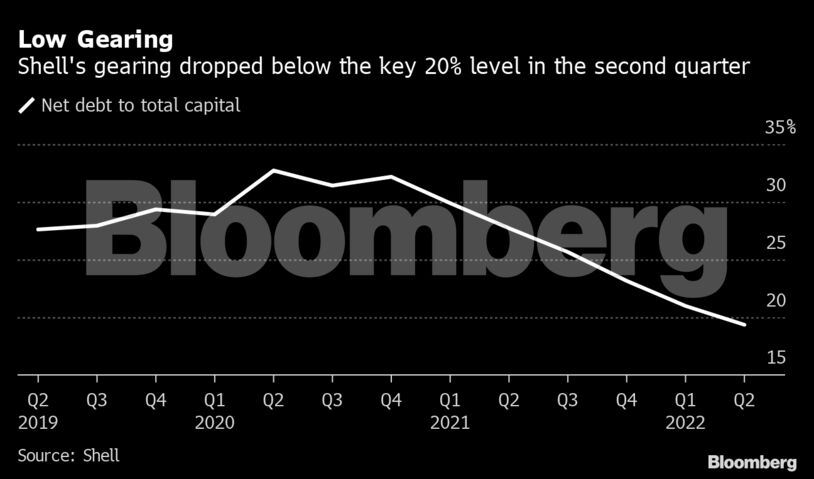

Even as Shell returned greater volumes of cash to investors, its debt level continued to drop. The company’s gearing, the ratio of net debt to equity, fell to 19.3% at the end of the second quarter. That’s a stark reversal for a measure that had risen above 30% at the depths of the Covid-19 pandemic.

“We are using our financial strength to invest in secure energy supplies which the world needs today,” Van Beurden said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso