West Texas Intermediate dropped near $102 a barrel. Covid cases continued to climb in Shanghai and other regions, with new sub-variants posing a challenge to the country’s Covid Zero strategy. Oil also fell on a stronger dollar, and on the cancellation of a court order halting loadings from a key Russian terminal.

A court in the Krasnodar region on Monday canceled an instruction to suspend shipments from the CPC terminal on Russia’s Black Sea coast, which mainly exports Kazakh crude. It’s due to ship 1.2 million barrels a day this month.

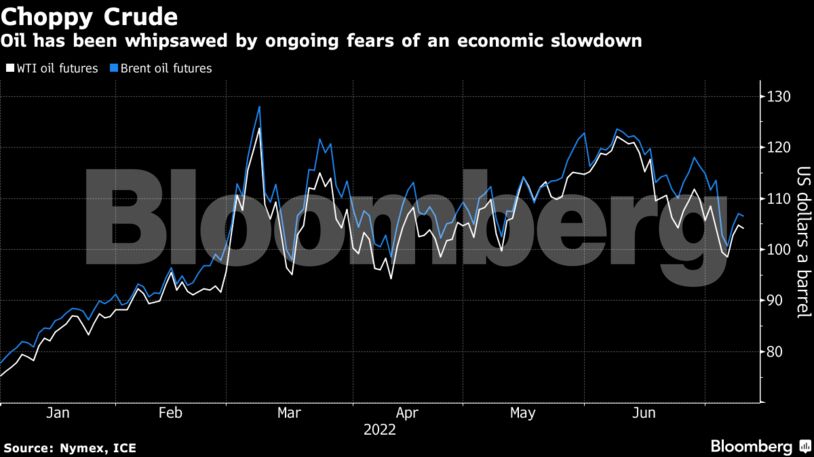

Oil dipped below $100 last week, then rebounded as the market was whipsawed by competing supply and demand outlooks. US President Joe Biden is scheduled to visit Saudi Arabia in the coming days during a tour of the Middle East as he seeks to tame rising energy prices that are weighing on the global economy.

There are some signs of relief for Biden. Gasoline prices — a major contributor to inflation and a central issue in US elections — have fallen for 27 days, including the single biggest daily drop in more than a decade. That’s the longest streak of declines since April 2020.

“The current illiquid trading environment and contrasting views make volatile swings regular occurrences,” said Tamas Varga, an analyst at PVM Oil Associates Ltd. “The immediate risk is probably skewed to the upside, but demand worries should come to the fore when the summer season passes.”

| Prices |

|---|

|

Speculators turned more bearish on the main oil benchmarks last week. Money managers cut net-long positions in both Brent and WTI to the lowest level since 2020, according to data released Friday.

Shanghai recorded 69 new Covid infections Sunday, the most since late May. China will unveil a raft of economic data this week, with the numbers set to be scrutinized for evidence of Covid Zero’s impact on the world’s No. 2 economy.

Yet the oil market is still supported by tight supply, in part due to upended trade flows from Russia following its invasion of Ukraine. Time-spreads have firmed in a bullish backwardation structure, which indicates scarce supply.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS