Supply disruptions offset some of the bearishness, with a slowdown in crude deliveries to America’s storage hub underscoring how tight inventories remain. TC Energy reduced operating rates on a segment of Keystone running from Canada’s oil sands to Cushing, Oklahoma, by about 15% following a power-supply disruption.

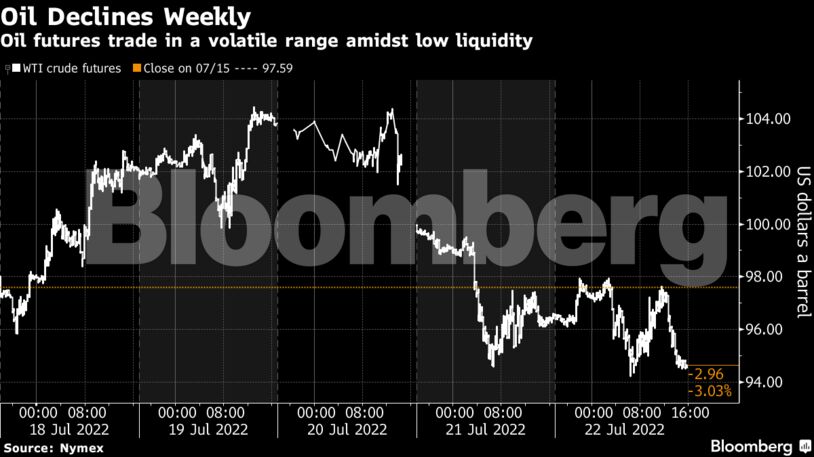

“Despite troubling signs for crude demand across China, Europe and the US, the oil market remains very tight and is not allowing WTI crude to break below the mid-$90s,” said Ed Moya, senior market analyst at Oanda Corp.

While crude remains more than a quarter higher since the start of the year, the bulk of the gains triggered by Russia’s invasion of Ukraine have been reversed. Central banks including the Federal Reserve have been raising interest rates to quell soaring inflation, triggering concerns of a slowdown that’ll sap demand for commodities including energy. That’s hurt investor interest in crude oil, and traders are also continuing to monitor China’s continued response to virus outbreaks.

| Prices: |

|---|

|

Meanwhile, the market hasn’t yet priced in the impact of European Union sanctions aimed at Russian supplies, which adds impetus to the price-cap plan, a US Treasury Department official said. In response to the news, the Bank of Russia governor said that Russia won’t sell oil to countries that cap the price.

In a phone call on Thursday, Saudi Crown Prince Mohammed bin Salman and Russian President Vladimir Putin discussed continued cooperation within OPEC+, the broad group that comprises the Organization of Petroleum Exporting Countries and its allies. “It was emphasized that a further coordination within OPEC+ is important,” according to a statement from the Kremlin.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire