Europe’s energy crisis reached a new level this summer as Russia started to progressively cut flows through the Nord Stream pipeline to Germany, citing sanctions-related issues with a turbine. European leaders have accused Moscow of weaponizing supply, even as severe restrictions were placed on Russia for its invasion of Ukraine that began in late February.

“We are in a situation in which gas is now part of Russian foreign policy and possibly part of its war strategy,” Klaus Mueller, president of Germany’s federal network agency, said Wednesday in an interview with Deutschlandfunk radio.

Supplies through Nord Stream, the biggest gas link from Russia to the European Union, fell to just 20% of capacity from Wednesday, according to German grids. It’s already materializing in reduced deliveries to buyers, with Italy’s Eni SpA saying its shipments from Russia will be about 21% less on Wednesday than in recent days.

Gazprom PJSC had warned this was coming, saying a turbine needed to be taken down for maintenance. Another similar piece of equipment that was stranded in Canada following repairs was heading back to Russia, but is yet to be pressed back into service.

Nord Stream Gas Flows Expected to Fall to 20% of Capacity

Europe is preparing for even tougher times ahead as the continent is still heavily reliant on Russian gas, even though they have been securing alternatives shipments. The EU’s aim to refill 85% of storage facilities before the winter hinges on curbing demand by 15% — a plan approved on Tuesday — because supply is unlikely to keep up even amid support from the LNG market, which is tightened by outages in the U.S. and competition from Asian buyers, according to Bloomberg Intelligence.

“European gas prices are rising sharply and may have record spikes as Russia further weaponizes supply by suppressing flows via Nord Stream,” BI analysts Patricio Alvarez and Will Hares said.

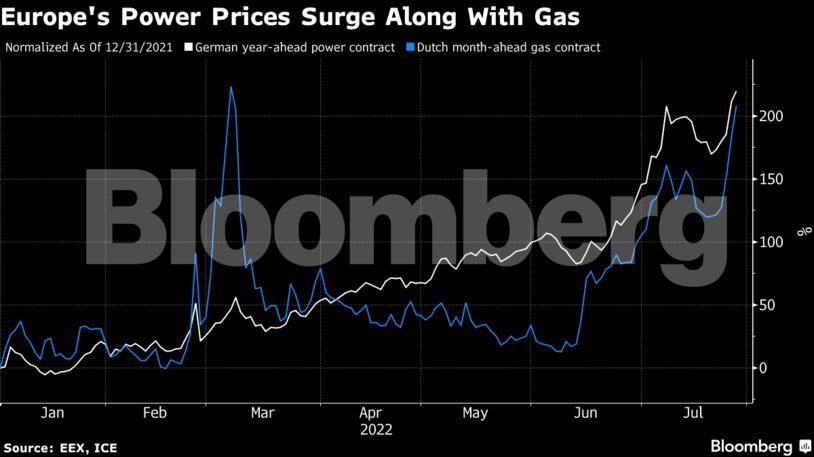

Dutch front-month futures, the European benchmark, surged 11% to 222 euros per megawatt-hour as of 9:46 a.m. in Amsterdam, rising for a sixth day. German benchmark power futures extended gains for a fifth day, with the year-ahead contract increasing 2.8% to 385 euros a megawatt-hour.

“The futures market remains highly volatile,” said Fabian Roenningen, analyst at Rystad Energy said. “Uncertainties in the gas market continue to be a price driver in the power market.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet