“While rotations within the equity market have signaled expectations of slowing growth, index valuation does not appear to be providing a buffer for the uncertainty around the path of future earnings,” strategists led by Ben Snider wrote in a note dated June 27. Profit margins for the median S&P 500 company will likely decline next year, whether or not the economy falls into recession, the strategists said.

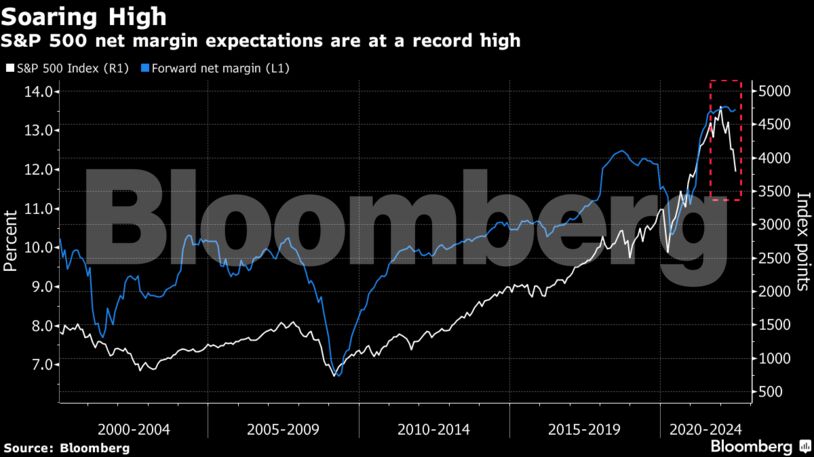

US stocks are in a bear market, with the S&P 500 headed for its worst first half since Richard Nixon’s presidency as fears of a potential global recession hammer risk appetite. But analysts have continued to be bullish about corporate earnings expectations, with net margin estimates for S&P 500 companies still at a record high.

HSBC Plc’s Max Kettner also said in a note that equity markets are still under-pricing the impact of a potential recession, while earnings and growth expectations are at risk of being revised lower. Morgan Stanley’s Lisa Shalett said on Monday analysts need a reality check about their earnings projections for this quarter.

“Economists have begun to cut their top-down economic forecasts for GDP, and yet fundamental company analysts are sitting there like deer in headlights not knowing what to do with numbers,” the Morgan Stanley Wealth Management chief investment officer said on Bloomberg TV.

Goldman strategists expect aggregate S&P 500 net profit margins to remain flat in 2023, even if the economy doesn’t contract. The risk is lower for the 10 biggest S&P 500 companies, they said, which account for 19% of the index’s earnings. The energy sector will also be a tailwind for aggregate index margins, benefiting from higher commodity prices.

“We continue to recommend investors focus on stocks where they can be relatively confident in the forward trajectory of earnings, including firms with stable growth and the Health Care sector, which has grown earnings in each of the last several recessions,” the team said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS