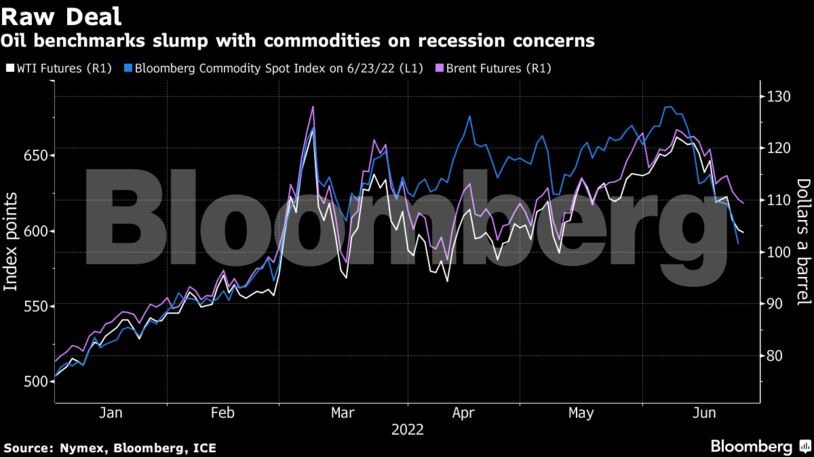

West Texas Intermediate traded near $105 a barrel after retreating over the previous two sessions. The US benchmark has lost almost 4% this week, putting prices on course for their first monthly drop since November.

In a highly volatile price environment this week, the oil market has been sending mixed signals.

A slump in headline prices has reflected concerns about a looming global recession. But timespreads — which are a proxy for how tight real world supplies are — have surged higher amid a renewed supply hit in Libya. Meanwhile refined product prices have also stayed high in the selloff.

Oil’s rally went into reverse earlier this month on escalating concern over a global slowdown as central banks, including the Federal Reserve boosted interest rates to quell raging inflation. Prices have sunk despite signs that energy markets remain tight in the near term as the war in Ukraine drags on and supply risks persist. In addition, key time spreads remain elevated.

“The threat of recession-induced demand destruction looms large,” said Stephen Brennock an analyst at brokerage PVM Oil Associates. “That being said, the consensus remains that the oil market will see high demand and tight supply over the summer months.”

| Prices: |

|---|

|

In a sign of the current tightness, oil market backwardation, a bullish pattern in which near-term prices trade above longer-dated ones. Brent’s prompt spread — the difference between its two nearest contracts — was $3.81 a barrel, up from $2.73 a week ago.

Read also: Demand for Crude Still Strong Despite Recession Fears

That in part reflects still-strong demand for real-world barrels. Cargoes for Asian buyers are fetching giant premiums to their benchmarks for August loading, signaling confidence in demand over the next few months.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein