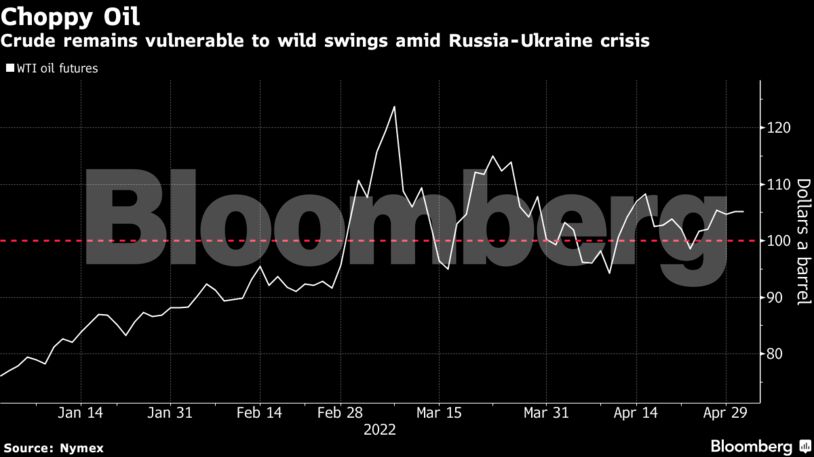

West Texas Intermediate futures slid 1.2%, reversing an earlier gain. Crude has swung within a $15 band in recent weeks as the market assesses the hit to demand from China’s Covid wave while supply concern persists amid the war in Ukraine. Investors are also bracing for the biggest U.S. rate hike since 2000.

Since spiking after Vladimir Putin’s invasion, oil has struggled to make further headway. A combination of lower demand in China and reduced supply from Russia has led to a period of volatility that’s boosted the cost of trading and forced some in the market to the sidelines. The wild swings could be set to continue, BP Plc said Tuesday.

“We’ve got low-ish stocks around the world, we’ve got low-ish spare capacity around the world and have a lot of uncertainty,” Chief Executive Officer Bernard Looney said in a Bloomberg Television interview. “All of these things lead to a lot of volatility and we can expect that volatility to continue.”

| Prices |

|---|

|

About 1 million barrels a day of Russian crude are offline, a number that could double this month, Looney said. The European Commission is set to propose a ban on Russian oil by the end of the year, with curbs on imports introduced gradually until then, according to people with knowledge of the matter.

For now, the most extreme pocket of tightness in the oil market is in diesel. Record fuel exports from the U.S. Gulf Coast are draining local supplies, pushing diesel margins to a fresh high. Retail prices have peaked in recent days.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein