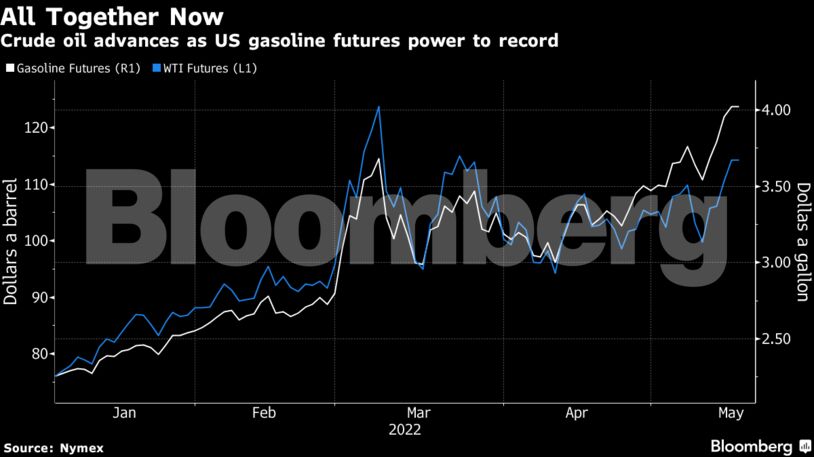

West Texas Intermediate traded near $115 a barrel after rallying about 14% over the previous four sessions. US retail gasoline prices topped $4.50 a gallon for the first time, just a couple of weeks ahead of the summer driving season. It comes amid widespread tightness in oil product markets across the globe.

In China, meanwhile, Shanghai reported no new Covid-19 infections in the broader community for a third consecutive day, hitting a crucial milestone that authorities have said will allow them to start unwinding punishing restrictions. Still, one part of of Beijing’s Fengtai district will lock down in some areas for seven days, underscoring the the country’s continued battle with the virus.

Oil has rallied more than 50% this year in extremely volatile trading as the war in Ukraine tightened supplies, while demand outside of virus-hit China picked up. Surging global inflation and a nascent interest rate increase cycle have also seen oil swing with the fortunes of wider markets, which were striking a risk-on tone on Tuesday.

“The prospect for a pickup in Chinese demand if they manage to get the virus under control will add another layer of price support,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S. Price moves were limited Tuesday “with the bear and bull pull being relatively equal right now,” he added.

| Prices: |

|---|

|

In Europe, a European Union proposal to ban imports of Russian crude in response to President Vladimir Putin’s invasion of Ukraine has been delayed amid opposition from Hungary. Josep Borrell, the bloc’s foreign policy chief, said ministers had decided to pass the deadlock back to ambassadors for more deliberations.

US crude stockpiles at a key storage hub in Cushing, Oklahoma, have contracted by about a quarter this this year. Holdings at the delivery point for benchmark US futures likely fell by about 2.629 million barrels in the week to May 13, traders said, citing data from consultant Wood Mackenzie Ltd.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire