Stockpiles of the heating and power-plant fuel are below normal for this time of year as exports are booming, and output from shale basins is muted. Traders anticipate higher-than-usual gas needs this summer to fuel US power plants as consumers and businesses crank up air conditioners to combat hotter weather. Meanwhile, hydro-power generation and coal supplies are severely constrained, leaving limited alternatives to gas.

Reflecting growing concerns about replenishing depleted stockpiles ahead of the winter, gas for July delivery has traded at an unusual premium over contracts for February. And the so-called widowmaker spread between gas delivered in March and April — essentially a bet on how low inventories will be by the end of winter — widened to the highest ever for this time of the year.

“It’s a function of the storage, and the storage situation is miserable,” said Bob Yawger, director of the futures division at Mizuho Securities USA. Gas prices could soon rise above $10, he said.

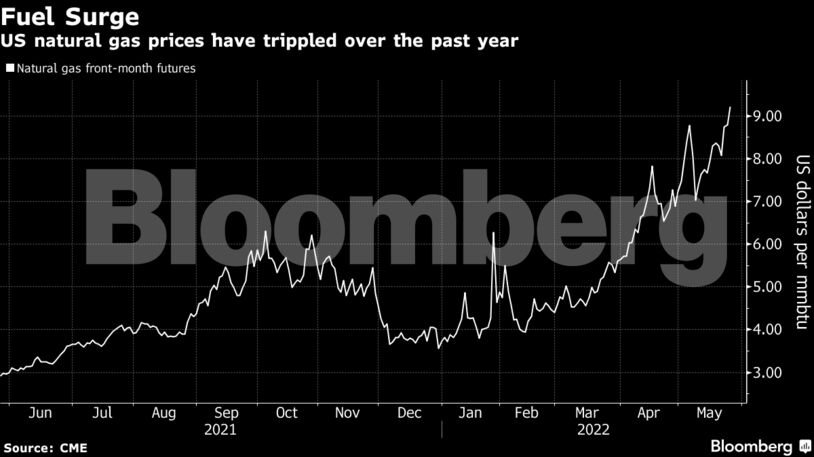

Gas prices have skyrocketed globally over the past year because of an energy crunch that has been aggravated by the war in Ukraine, with buyers in Europe and Asia vying for US supplies of liquefied natural gas. Venture Global LNG said Wednesday that it’s moving ahead with a second LNG terminal on the Gulf Coast after securing $13.2 billion of financing, while Cheniere Energy Inc., the largest US LNG exporter, signed a sale and purchase agreement with South Korea’s POSCO International.

Though the fuel is still much cheaper in the US than elsewhere because of the nation’s relatively abundant shale supplies and limited export capacity, the gap has been closing. Henry Hub futures are now trading at roughly a third of the price for the European benchmark, up from about 7% in early March.

The expiration of gas contracts for June delivery later this week may also be driving volatility. Money managers exposed to bearish wagers have struggled to close out those positions over the past couple of days, according to Dennis Kissler, senior vice president at Bok Financial Securities.

| Prices |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire