Apr 25, 2022

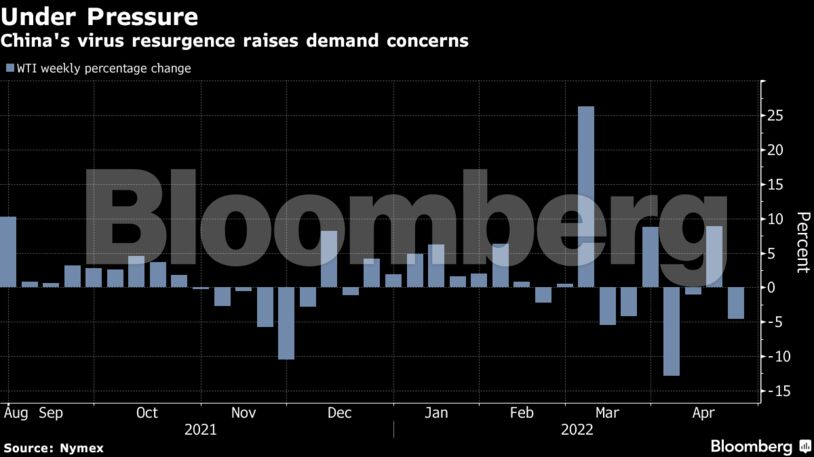

Oil fell at the start of the week on concerns that a spreading Covid-19 outbreak in top consumer China will weigh on global demand.

West Texas Intermediate futures slid almost 5% to trade below $98 a barrel amid a rout in stocks and other raw materials. Rising cases in Beijing sparked jitters about an unprecedented lockdown of the capital, while Shanghai reported record daily deaths over the weekend. The world’s biggest crude importer is heading for the worst oil demand shock since the early days of the pandemic.

China’s travails with Covid-19 add another source of volatility to an oil market that’s been whipsawed by the Russian invasion of Ukraine. The war has fanned inflation, and the European Union is discussing measures to restrict oil imports from Russia.

China has implemented lockdowns in a number of cities as it pursues a Covid Zero strategy. Residents in a Beijing district were told to submit to three days of virus testing starting Monday in a bid to curb cases in the area. As the risks to consumption escalate, money managers have turned the least bullish on WTI since April 2020, the month prices turned negative.

“The big story in oil continues to be China,” said Keshav Lohiya, founder of consultant Oilytics. “The hit to domestic demand will be significant if Beijing follows Shanghai’s route.”

| Prices |

|---|

|

The market is poised for additional supply, adding to bearish signs. Libya is expected to resume output from shuttered fields in the coming days, while the CPC oil terminal on Russia’s Black Sea coast has resumed regular operations after one of two moorings damaged in a storm was repaired.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire