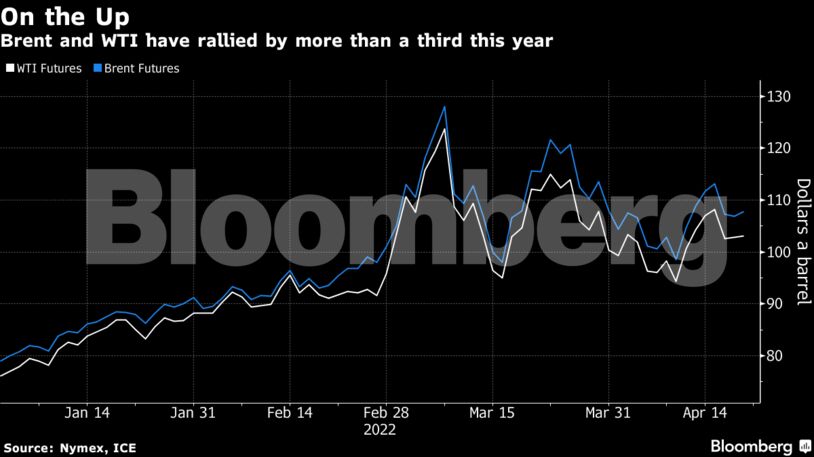

Oil has been hugely volatile since the outbreak of war. After spiking above $130, prices have retreated amid a liquidity crunch, with traders fleeing the market in the face of extreme volatility and onerous margin calls. Open interest in WTI futures continues to fall, indicating that the pullback in activity is ongoing.

“The oil market continues to be characterized by a tug-of-war between concerns about demand and concerns about supply outages,” said Carsten Fritsch, an analyst at Commerzbank AG. “This is also evident from the constant fluctuations in oil prices.”

| Prices: |

|---|

|

In China, meanwhile, officials are struggling to eradicate a wave of Covid-19 in key cities. Strict curbs have hurt mobility, including for the nation’s fleet of trucks, and banks are reducing their forecasts from the nation’s expansion this year. President Xi Jinping told a local forum that while economic fundamentals remain strong, “we have yet to walk from the shadow”of the pandemic.

Other corners of the globe are seeing indications of robust fuel demand though. On Wednesday the 3-2-1 futures crack spread in the U.S. — a measure of the profitability of turning crude into gasoline and diesel — shot up to the highest level in records going back to 1986. In Europe, France’s oil-product sales were above pre-Covid levels in March.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Markets Call Trump’s Bluff on Russian Oil Sanctions in Increasingly Risky Game – Bousso