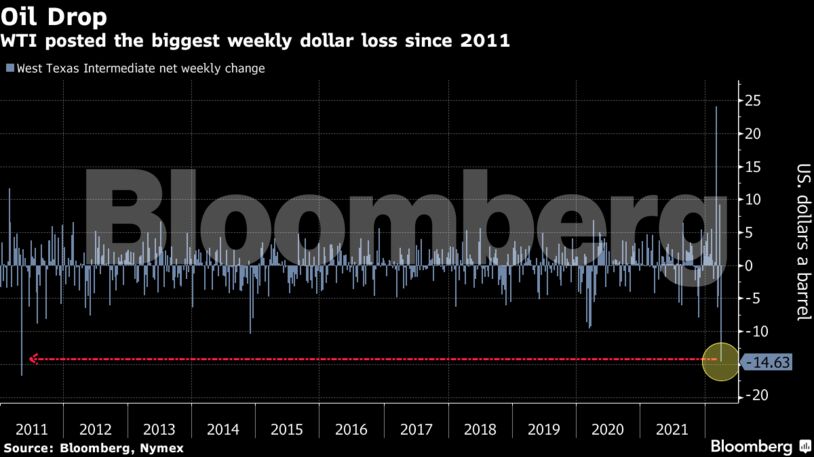

Oil posted its biggest weekly loss in more than 10 years after the Biden administration ordered an unprecedented release of U.S. strategic reserves to tame rampant prices.

West Texas Intermediate dropped 1% on Friday and over $14 dollars this week, the most since 2011. The U.S. plans to release 1 million barrels a day for six months.

IEA nations also agreed to release another round of crude stockpiles, with volumes to be decided later. U.S. President Joe Biden expects allies to release an additional 30 million to 50 million barrels.

Citigroup Inc. said the U.S. appeared to have taken steps to ensure that it could deliver the promised volumes, despite having never drawn down that much oil from the reserve stockpile. Goldman Sachs Group Inc. cut its price forecasts for this year but boosted the estimate for 2023, arguing that the move won’t fix a longer-term supply crisis.

Releasing 1 million barrels a day from the U.S. Strategic Petroleum Reserve “can easily be accomplished,” said Andy Lipow, president of Lipow Oil Associates LLC in Houston.

Biden’s decision follows rocketing gasoline prices in America and concerns about supply shortages following Russia’s invasion of Ukraine. The war has roiled global commodity markets and driven up the price of everything from fuels to food. It has also led to tumultuous trading in oil, with massive intraday swings throughout March. WTI traded in almost a $37 range last month.

The U.S. already tapped its reserves twice in the past six months, but that’s done little to cool prices. As much as 180 million barrels may be released this time.

“The market is short about 2 million barrels a day, if not more, from Russian supplies into the global market,” Amos Hochstein, the U.S. State Department’s senior energy security adviser, said in an interview on Bloomberg Television.

| Prices |

|---|

|

The Biden administration’s giant oil release contrasts sharply with OPEC+, which on Thursday ratified a planned, modest production increase of about 430,000 barrels a day. The cartel is struggling to keep up with production, having roughly added a third of the volume planned in March, according to a Bloomberg survey.

The market also came under some technical pressure Friday as WTI fell below its 50-day moving average for the first time since early January. Brent also slipped toward that level before rallying away from it.

Also contributing to this week’s slide were concerns about Chinese demand as the world’s biggest oil importer implements a series of lockdowns to curb a resurgence of Covid-19. Those curbs are starting to affect the economy, with manufacturing activity contracting in March.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein