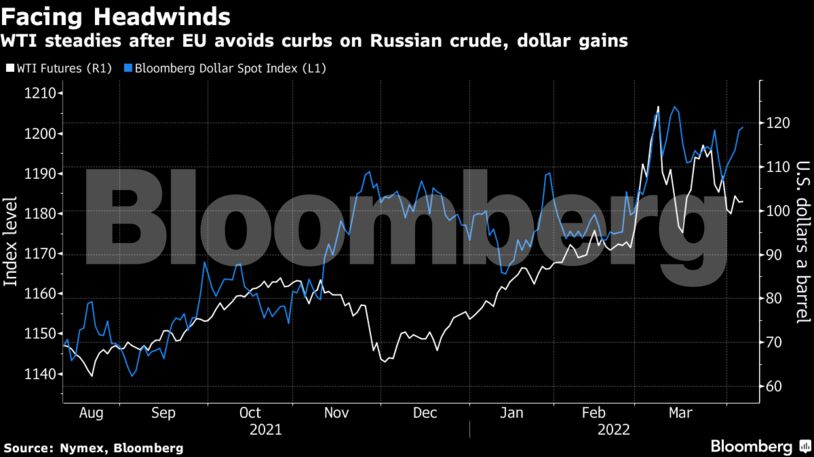

West Texas Intermediate edged above $103 after trading in a choppy range of more than $7 so far this week. The U.S. and its allies are coordinating on a new round of sanctions to punish the Kremlin for the alleged murder of civilians by its troops in Ukraine. The European Union won’t yet sanction oil, but European Commission President Ursula von der Leyen said the bloc will push ahead with a debate among members on tackling Russian oil.

Oil prices surged by a third in the first quarter as the Russian invasion and backlash from the EU and U.S. roiled markets. While the U.K. and Washington have moved to bar Russian crude, it’s harder for the EU to follow suit given the region’s far higher level of dependence.

Washington and allies in the International Energy Agency have also tapped strategic petroleum reserves to try to calm prices, while the coronavirus outbreak in China has also helped prices to pull back.

“Everything to me points to the market being in a pretty difficult place on the supply side,” said Callum Macpherson, head of commodities at Investec Plc. “The main bearish point I can see is the China Covid outbreak, everything else looks pretty bullish.”

| Prices: |

|---|

|

The coronavirus outbreak in top oil importer China is hurting energy demand as cities including Shanghai have been placed under lockdown. The country reported more than 20,000 new cases for Tuesday.

A weekly industry snapshot pointed to a modest gain in U.S. inventories. Figures from the American Petroleum Institute on Tuesday showed a 1.1 million barrel increase nationwide, as well as a rise at the key hub in Cushing, Oklahoma, according to people familiar with the data.

Later on Wednesday, the bosses of Chevron Corp., Devon Energy Corp., ExxonMobil Corp., and Pioneer Natural Resources Co., and local heads of BP Plc and Shell Plc are set to testify in the U.S. on oil and gas prices before the House Energy and Commerce Committee. Average retail gasoline prices hit a record last month, according to data from the American Automobile Association.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire