West Texas Intermediate futures have struggled for direction this week, erasing earlier losses to trade little changed on Thursday. Hangzhou is the latest Chinese city to start mass virus testing, while the nation’s top state-run oil processor said during an earnings call that the resurgence was slowing fuel demand.

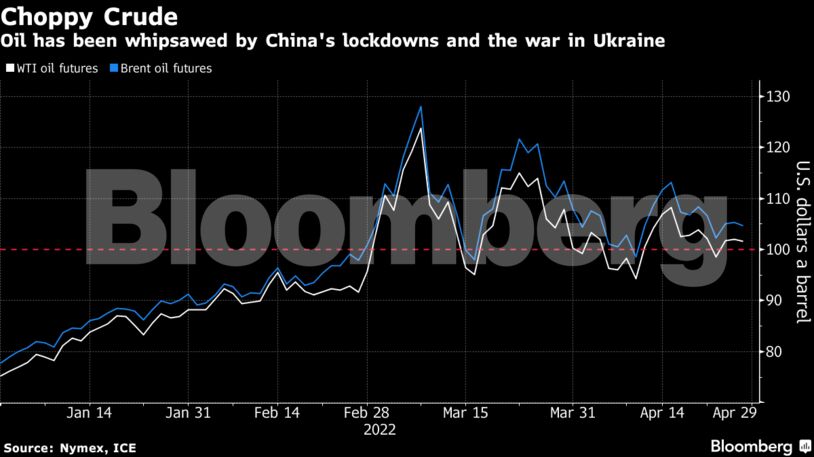

The oil market has been gripped by a volatile period of trading since Russia’s invasion of Ukraine in late February and the more recent Covid-19 comeback in China. Traders are also grappling with just how big the hit to Russian supply will be. Surging oil product prices — U.S. diesel futures are at a record — point to a tight underlying market for refined products.

“It is remarkable how we end up with this sideways trading,” said Hans van Cleef, senior energy economist at ABN Amro. “The lower demand due to the Chinese lockdowns is fully balancing out the supply fears of lower exports from Russia.”

Russia’s finance minister said the nation’s oil output may drop by as much as 17% this year as buyers shun its crude. The U.S. and U.K. are banning imports from the OPEC+ producer, while the European Union discusses similar steps. Germany said it was prepared to back a gradual ban.

| Prices |

|---|

|

It’s not just diesel markets that have been strong of late. On Wednesday profits from turning crude into gasoline were the highest since 2013 in the U.S. That came after inventories of the fuel fell for a fourth week.

The U.S. East Coast is bearing the brunt of the tightness in part because shrinking refining capacity has led to increased reliance on U.S. Gulf Coast shipments. However, Gulf Coast processors are instead exporting more fuel at a premium as buyers in Latin America and Europe replace Russian supply.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein