By Grant Smith

With the weaker demand outlook and the massive release of emergency oil reserves by IEA members, the agency now sees global markets in balance for much of the year. Crude prices have already lost most of their gains since Russia’s attack on Ukraine, to trade near $100 a barrel in New York on Wednesday.

“We’re seeing now that economic forecasters are continuing to downgrade their outlook for the world economy, and obviously this will have an impact on oil demand,” Toril Bosoni, head of the IEA’s markets and industry division, said in a Bloomberg Television interview. “The market does look more balanced.”

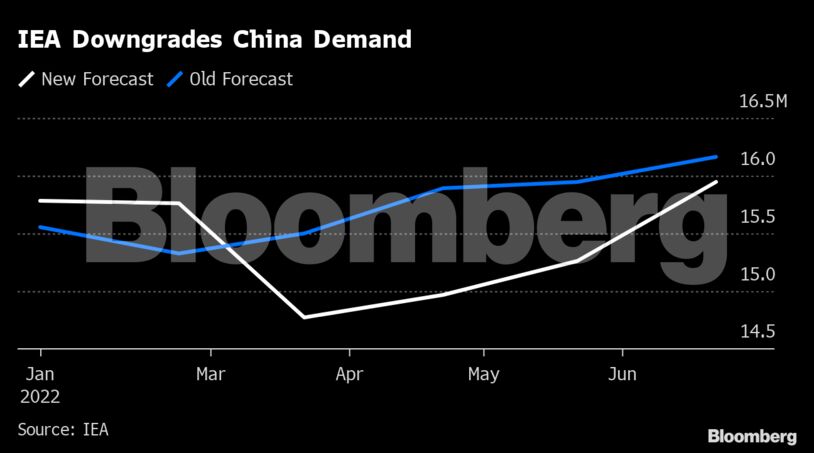

The Paris-based agency, which advises most major economies, lowered projections for world fuel consumption this year by 260,000 barrels a day, with a particularly steep reduction of 925,000 a day for China in April. Still, global demand remains on track to increase this year.

The IEA also dialed back estimates for the loss of Russian supplies from an international boycott over its military aggression. Production in April may be 1.5 million barrels a day lower than the prior month — roughly half the drop that was previously expected. Those losses may still double in May, the IEA said.

Oil surged well above $100 a barrel following Russia’s attack on its neighbor. While prices have eased, they are still high enough to stoke inflationary pressures and exacerbate a cost-of-living crisis for millions of consumers. To counter this, IEA members announced last week that they will deploy 240 million barrels from emergency reserves, the biggest stockpile release in the agency’s history.

China’s Outbreak

“Prices are now back to near pre-invasion levels, but remain troublingly high and are a serious threat for the global economic outlook,” the IEA said.

World oil consumption will expand by 1.9 million barrels a day to average 99.4 million a day this year, according to the IEA.

“Oil demand is still recovering from Covid,” said Bosoni. “The aviation sector is recovering, there’s pent-up demand, so we are expecting growth. But obviously downside risk if the economic outlook deteriorates.”

China’s fierce zero-Covid policy has diminished demand growth, as millions are locked down in their homes, imports drop and business activity slows in the world’s second-biggest economy.

The IEA noted that Saudi Arabia and other members of the Organization of Petroleum Exporting Countries have refused to open the taps faster, partly from a belief that markets didn’t face a genuine shortage, and partly to preserve the OPEC+ coalition they lead with Russia.

OPEC+ members managed to provide just 10% of the supply increase scheduled for March, according to the IEA. The 19 coalition members, which have been engaged in a pact to stabilize markets since the start of the pandemic, added a mere 40,000 barrels a day as diminished investment erodes production capacity across the group.

The clash over policy between OPEC+ and the IEA — which has openly expressed disappointment with the cartel’s inaction — came to a head last month with OPEC abandoning the agency as one of its data sources.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS