The repurchases will be made through the end of next year, Exxon said in a statement on Friday. The oil giant more than doubled first-quarter adjusted net income to $8.8 billion, or $2.07 a share, lagging estimates by 17 cents.

Chief Executive Executive Darren Woods cited a dip in output from oil and natural gas wells stemming from adverse weather and other factors. Exxon fell as much as 2% in pre-market trading.

The oil giant took a $3.4 billion writedown due to its planned exit from its Sakhalin-1 operation in Russia, compared with a previously announced estimate of as much as $4 billion. The company declared force majeure at the venture earlier this week and curtailed crude production.

Exxon follows TotalEnergies SE and Chevron Corp. in posting first-quarter results. The French oil titan pledged to buyback as much as $3 billion in shares before the end of June while Chevron disclosed its biggest profit in almost a decade.

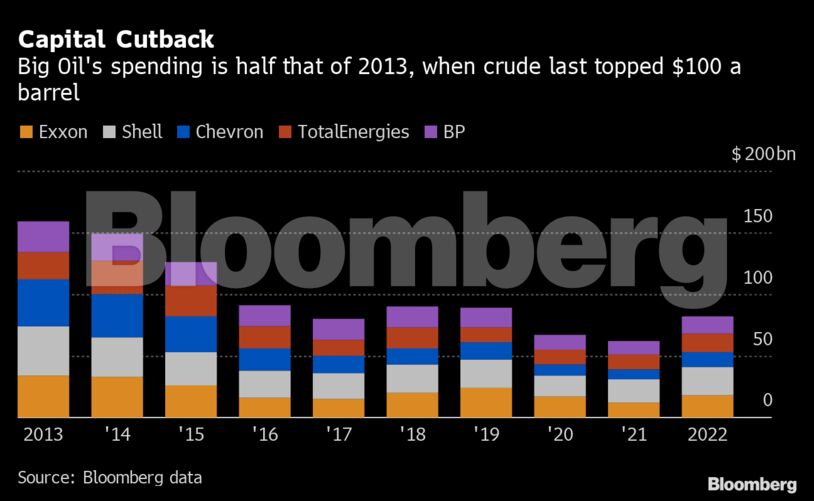

Big Oil’s windfall profits come as consumers feel the pinch of surging energy prices, prompting some politicians to demand explorers invest more in new wells to counter Russia’s growing isolation. So far, oil executives are funneling cash to shareholders through dividends and buybacks, fueling calls from some quarters for the imposition of windfall profit taxes.

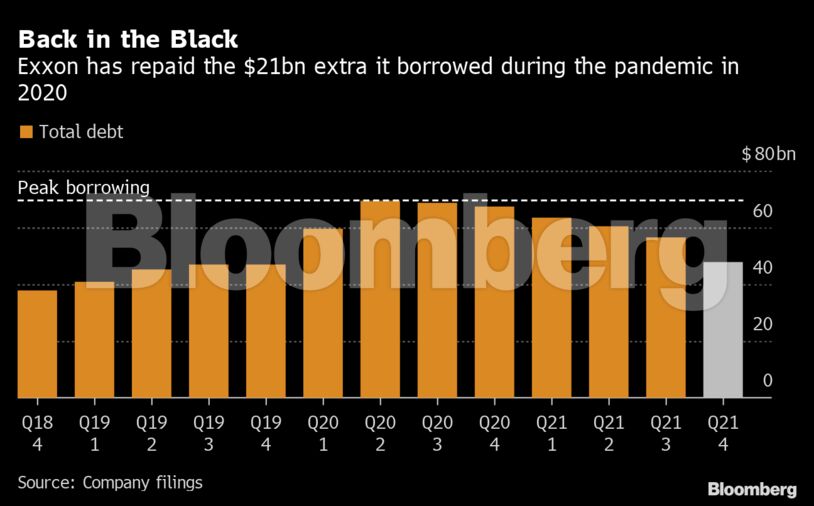

The rapid rebound in oil prices came at just the right time for Exxon. In 2020, the Western world’s biggest oil company increased debt by 45%, or nearly $21 billion but the recent boom enabled it to repay the entire sum, as well as ramping up returns to shareholders. The stock is up about 40% this year, exceeding the return in the S&P 500 Energy Index.

One disappointment for shareholders was that Exxon failed to increase dividends this week as some analysts had been expecting, but it’s likely to raise the payout later this year.

Woods is focused on quickening production in two key areas: U.S. shale and Guyana, where it made the world’s largest oil discovery of the past decade. The oil giant plans to boost production from the Permian Basin this year and its Guyanese Liza Phase 1 operation is currently producing 10,000 barrels a day above nameplate capacity.

Exxon’s third Guyana project, Payara, is running five months ahead of schedule and is due to come online before the end of next year, the company this week.

Such increases will not only help stabilize Exxon’s long-term production decline, but they’re also highly profitable barrels. About 90% of its investment dollars are expected to make double-digit returns even were oil to fall to $35 a barrel, the company said in March. International benchmark crude futures currently trade at about $105.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS