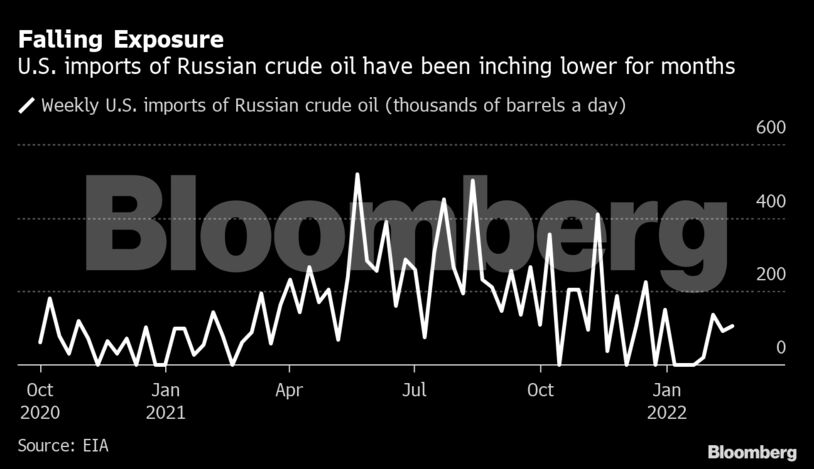

January saw virtually zero U.S. imports of Russian crude, with some volumes slated to arrive in February and March purchased before Russia’s invasion of Ukraine. So far, there haven’t been any signs of fresh bookings as buyers look elsewhere for supply.

Russian oil made up only about 3% of all the crude shipments that arrived in the U.S. last year, data from the U.S. Energy Information Administration show. U.S. imports of Russian crude so far in 2022 have dropped to the slowest annual pace since 2017, intelligence firm Kpler said.

Still, it may be surprising that the country imports any Russian oil at all, given that the U.S. produces more crude than Saudi Arabia.

It’s because the vast majority of U.S. crude is light, sweet oil, meaning it’s low in sulfur content and density. Russia’s flagship oil grade Urals is rich in sulfur, something U.S. refiners are particularly well designed to handle and often find themselves needing more of. Most of the denser, high-sulfur crude the U.S. needs comes from its closest neighbors — Mexico and Canada — but refiners are occasionally in the market for more.

When the U.S. does import Russian oil, it tends to flow toward the refiners located on the East Coast and West Coast, located far away from the heart of the oil and gas hub in the Gulf Coast region. Refiners on either ends of the country rely more on imports to satisfy their crude needs because pipeline connections from the production hubs in Texas and North Dakota to the coasts are limited. Additionally, the Jones Act requires U.S.-flagged vessels move shipments between U.S. ports, limiting the ability to ship American-pumped crude to cities along the coasts.

When also including other petroleum products, like unfinished fuel oil that can be used as a feedstock to produce gasoline and diesel, Russia accounted for about 8% of the U.S.’s 2021 oil imports, though those shipments have also been trending lower in recent months.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire