West Texas Intermediate futures topped $112 a barrel. European Union and NATO leaders are set to gather in Brussels on Thursday to beef up their response to the crisis. Ahead of the meetings, White House National Security Adviser Jake Sullivan said that the U.S. and its allies will impose further sanctions on Moscow.

As the conflict drags on, the EU is weighing a possible ban on Russian crude imports, though members including Germany have opposed such a move. Many buyers though are already shunning the nation’s oil, with TotalEnergies SE saying it will stop purchases by the end of the year, while Japanese refiner Eneos Holdings Inc. will halt new shipments.

Prices were also pushed higher on Wednesday as a key Kazakh-Russian oil pipeline may be forced to reduce shipments via the Caspian Pipeline Consortium’s terminal on the Black Sea by as much as 1 million barrels a day due to storm damage. Russian Deputy Prime Minister Alexander Novak said the repairs could take up to two months.

“Prices are ticking higher with focus on tomorrow’s EU and NATO meeting, not least considering the potential bullish market impact should the EU decide to embargo oil and fuel products from Russia,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S. The CPC disruption “is the last thing the market needs right now.”

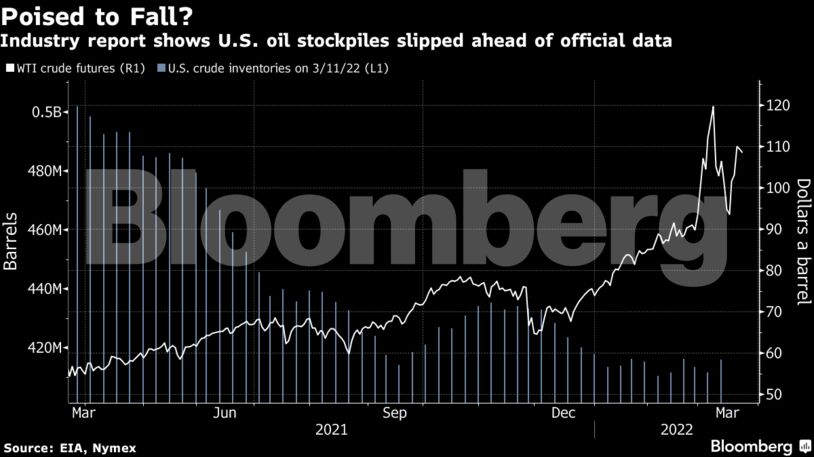

Further bullish signals came from the industry-funded American Petroleum Institute data showing crude inventories sank by 4.3 million barrels last week, according to people familiar with the numbers.

| Prices: |

|---|

|

With many buyers avoiding Russian crude, the country’s flagship Urals grade has plunged, while some April-loading shipments were canceled. That’s adding to the signs of increased pressure on the nation’s oil market.

Nevertheless, some Russian flows are still finding takers. India’s refiners have grabbed multiple cargoes of Urals crude this month, while China’s private processors are thought to be targeting favored grades from the east of Russia.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet