Mar 15, 2022

(Bloomberg)

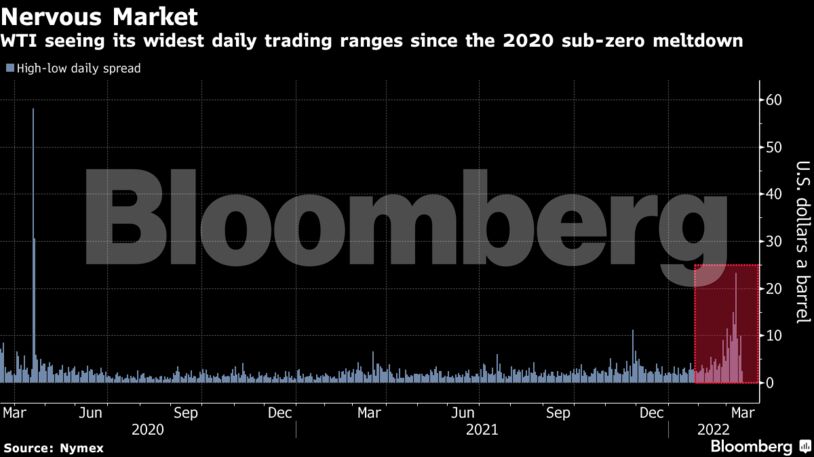

The heat is coming out of the oil market, and fast. West Texas Intermediate oil futures dropped below $100 a barrel on Tuesday, having shed more than 20% in a tumultuous week of trading that’s seen wild price fluctuations.

The latest developments to rattle the market are a resurgence of Covid-19 cases in China, the world’s biggest crude importer, and what appears to be progress in cease-fire talks between Ukraine and Russia.

While there are still concerns that the disruption to Russian oil flows is squeezing an already tight market, OPEC and others have been quick to point out there is no shortage.

The market is also in the midst of a liquidity crunch, leaving prices vulnerable to big swings. Clearing houses have been increasing margins — effectively making it more expensive to trade the same amount of oil — and open interest has collapsed to the lowest since 2015. The gap between bids and offers for WTI was six cents at times on Tuesday — it would usually only be about half that amount — another sign of a less active market.

China’s latest virus outbreak, with growing clusters spawned by the highly infectious omicron variant in some of its most-developed cities and economic zones, is an unprecedented challenge for the country’s Covid Zero strategy. The nation injected more funds into the financial system and set a weaker-than-expected reference rate for the yuan, seeking to support the economy.

“Risk premium seems to evaporate swiftly from oil prices,” said Norbert Ruecker, an analyst at Julius Baer. “The pandemic and health restrictions weigh on China’s economic outlook and thus oil demand.”

While buyers continue to shun Russian crude, there are signs that exports might not be completely cut off as some deals retreat from the public eye. Surgutneftegas PJSC is offering financing flexibility to some customers in order to keep crude flowing, while India is working out a mechanism to facilitate trade using local currencies. Still, the value of Russia’s Urals crude keeps moving lower.

| Prices: |

|---|

|

Ukraine’s main negotiator said the two sides were working on a potential cease-fire before talks were paused to take stock. The U.S. and China also had a “substantial discussion” in their first high-level meeting on the war. The Federal Reserve, meanwhile, is expected to start tightening monetary policy this week, which is weighing on markets in general.

The invasion has rippled through markets, fanning inflation as governments try to encourage growth after the pandemic. U.K. lawmakers were told by consultant Energy Aspects Ltd. that Britain may have to ration products like natural gas and diesel if the war continues. Consumers are already feeling the pain at the pump, with prices of transport fuels rising across the globe.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire