Crude has been hugely volatile after a spike to near $140 sapped liquidity from the market. That led to a sharp pullback, with intraday swings still frequently exceeding $5. There are signs that traders have been stepping back from the wild price gyrations by curbing their holdings of futures contracts.

There’s a lack of consensus in the EU — which has already imposed a raft of sanctions on Moscow — over whether to target Russian oil. Germany is reliant on Russian crude imports and has so far rejected a proposed embargo, while Hungary is also against it. EU leaders are set meet Thursday, and any decision would need to be agreed by all 27 states.

“Uncertainty regarding a possible EU oil ban is keeping the markets busy,” said Hans Van Cleef, senior energy economist at ABN Amro. “Still, there is not enough support for an oil ban now, and it probably will remain difficult in the near future.”

| Prices: |

|---|

|

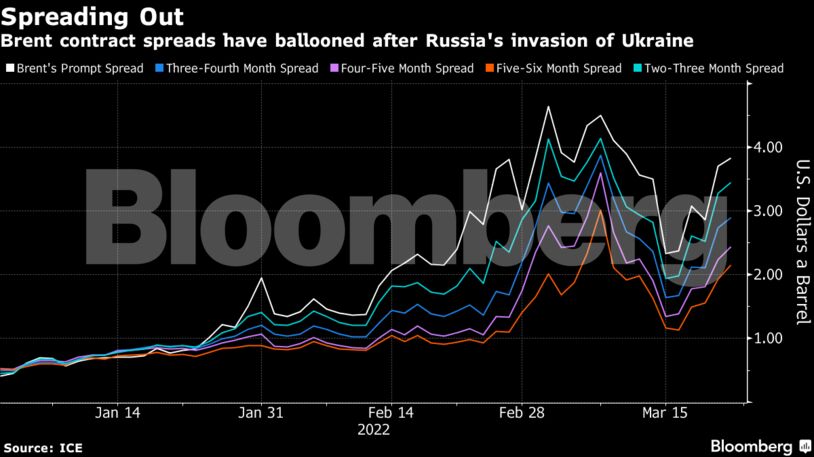

Brent’s so-called prompt spread — the differential between its two nearest contracts — was $3.72 a barrel in backwardation, a bullish pattern in which prompt prices trade above those further out. That compares with $3.70 a barrel on Monday, and just 41 cents at the start of the year.

The jump in oil is fanning already-elevated inflation in economies around the world, complicating the task for monetary policy makers including the Federal Reserve. Chair Jerome Powell said Monday that the U.S. central bank is prepared to raise interest rates by a half percentage-point at its next meeting if needed.

An additional lift on the demand side came from China as Beijing said it would step up support for the economy, reiterating earlier pledges. In a meeting of the State Council chaired by Premier Li Keqiang, the cabinet called for monetary tools to sustain credit expansion at a stable pace, while the authorities also promised to maintain policies that can support growth.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein