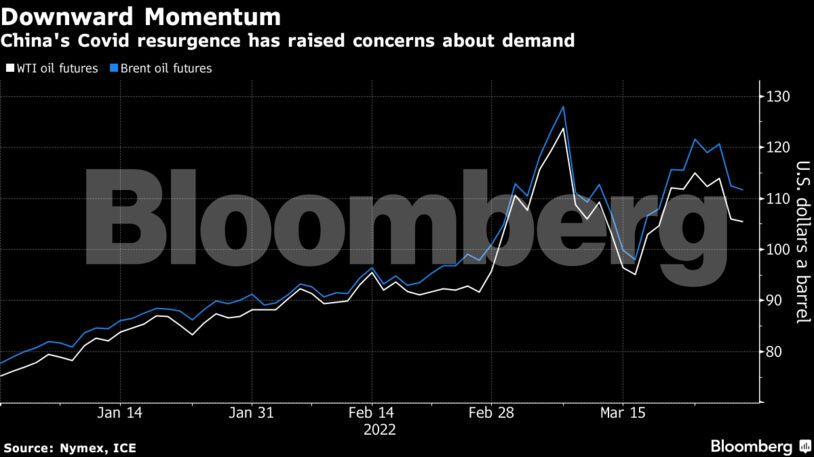

West Texas Intermediate futures inched up to trade near $107 a barrel. China, the biggest crude importer, is tackling its worst Covid-19 outbreak since Wuhan more than two years ago. The highly contagious omicron variant is testing its Covid Zero strategy, which has seen Shanghai crank up lockdown restrictions.

Shanghai’s latest curbs could cut oil demand by as much as 200,000 barrels a day for the duration of the measures, according to estimates from Rystad Energy AS. About 62 million people in China are either subject to a lockdown or facing one imminently, Bloomberg calculations show.

The situation in China, as well as the war in Ukraine and a drop in Kazakh oil production, will feed into talks between members of OPEC+ on Thursday. The alliance has signaled it will stick to its existing output plan and ratify another modest increase in oil supply for May.

Saudi Arabia, the group’s co-leader, will probably boost key crude prices for Asian customers to a record for May-loading cargoes, according to a Bloomberg survey, signaling a bullish outlook despite Chinese demand concern. State-run oil giant Saudi Aramco didn’t respond to an email seeking comment. The company typically releases official prices in the first five days of the month.

Meanwhile, Ukraine said it’s striving for a cease-fire deal in talks with Russian negotiators starting Tuesday. The country’s foreign minister said it has a minimum goal of improving the humanitarian situation. Russia’s oil output has fallen as buyers shun the nation’s exports following its invasion of Ukraine.

“The oil market remains highly volatile and it is still not clear who will make up for the expected shortfall due to the drop in Russia’s output,” said Jens Pedersen, a senior analyst at Danske Bank. “Hence, the selloff yesterday will likely prove short-lived.”

Oil is still heading for a monthly gain as Russia’s war in Ukraine rattles global markets. The conflict has fanned inflation, driving up the cost of everything from fuels to food as consumption recovers from the pandemic.

| Prices |

|---|

|

Brent remains in a bullish structure, where near-dated contracts are more expensive than later-dated ones, despite easing over the past week. The prompt timespread for the global benchmark was $2.99 a barrel in backwardation, compared with $3.65 a week ago.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Where the Fight Against Energy Subsidies Stands – Alex Epstein