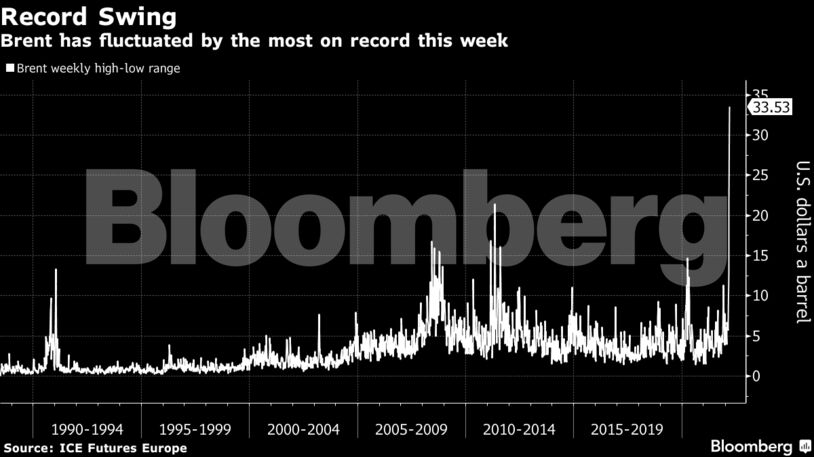

Futures in London were trading above $113 and have posted the biggest high-to-low range on record this week. West Texas Intermediate has swung the most since it turned negative in 2020 and was trading near $110.

Iran nuclear talks were halted in Vienna on Friday, with no indication of when or if they will resume. The market has been whipsawed by news of the U.S. ban on Russian crude imports and what looked to be the first signs of OPEC+ disunity.

There continues to be signs that Russian oil is being shunned, with no buyers in a tender for crude from the country’s far east. Citigroup said this week that it could still take four to six months for Russian production to decline, assuming exports fall by 2 million barrels a day.

The fallout from the war has rippled through commodity markets from wheat to key fuels such as gasoline and diesel, increasing inflationary pressure around the world. Rystad Energy predicted Brent could soar to an eye-watering $240 a barrel this summer if countries continue to sanction Russian oil imports.

Mounting sanctions on Russia in response to its invasion of Ukraine have prompted fears that an already tight market may be stretched further, though OPEC and Chevron Corp. stressed this week that there is no shortage of barrels. Banks such as Goldman Sachs Group Inc. say that only demand destruction can halt the price rally.

“Extreme intraday volatility perhaps says something about several things: degree of uncertainty, the nature of the news flow, the spillover from some chaotic spot markets and the relatively low liquidity levels at some points,” said Paul Horsnell, head of commodities research at Standard Chartered Plc.

| Prices |

|---|

|

Open interest in the main oil futures contracts has plunged to a six-year low in recent days as traders retreat from risk. Volatility has rocketed, and exchanges have been boosting margins, effectively raising the cost of buying and selling. Brent has been as high as $139 a barrel and as low as $105 this week.

The UAE on Wednesday called on OPEC+ to boost output faster, though the nation’s energy minister appeared to later temper that message. The cartel, which counts Russia as a key member, has resisted calls from consumers to pump more, arguing that the surge in prices is driven by geopolitical tensions rather than a supply shortage.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire