“There was likely some investor apprehension heading into Enphase’s fourth-quarter earnings call as the calendar turning to 2022 has done little to assuage concerns over 2021’s supply chain issues,” BMO Capital Markets analyst Ameet Thakkar wrote in a note to clients. Instead, the results suggested there is no longer a component shortage holding back the company, even though it now needs to contend with high logistic costs and longer transportation lead times, the analyst said.

“It appears the company has been able to continue to pass on a portion of these costs through price increases,” Thakkar added.

Enphase, one of the first solar companies to report earnings, supplies components that convert the energy from panels into alternating current and travel over power lines. Its results boosted optimism for peers as earnings indicate strong demand for panels this year after supply constraints in 2021 hindered shipments and delayed projects.

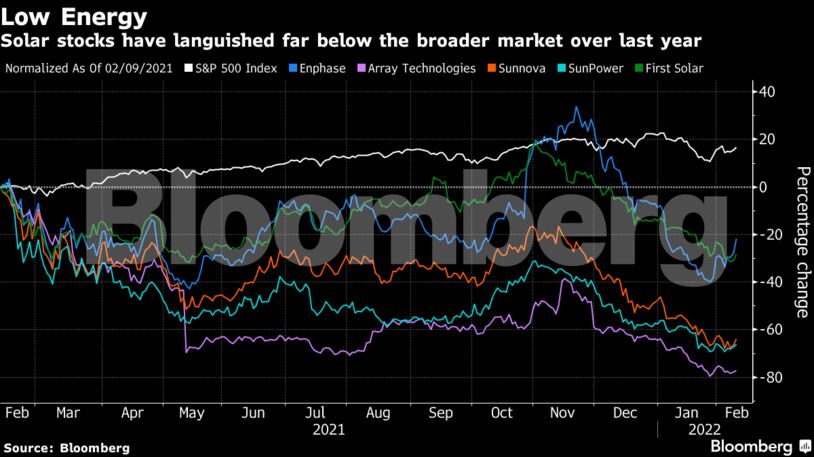

Enphase in recent months has seen its shares languish along with peers, even as the broader market powered on. Despite Wednesday’s rally, Enphase shares are down 19% over the year, at a time when the S&P 500 Index gained 17%.

Competitors Array Technologies Inc. fell 77% over the same period, Sunnova Energy International Inc. retreated 64%, SunPower Corp. declined 65% and First Solar Inc. fell 27%.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS