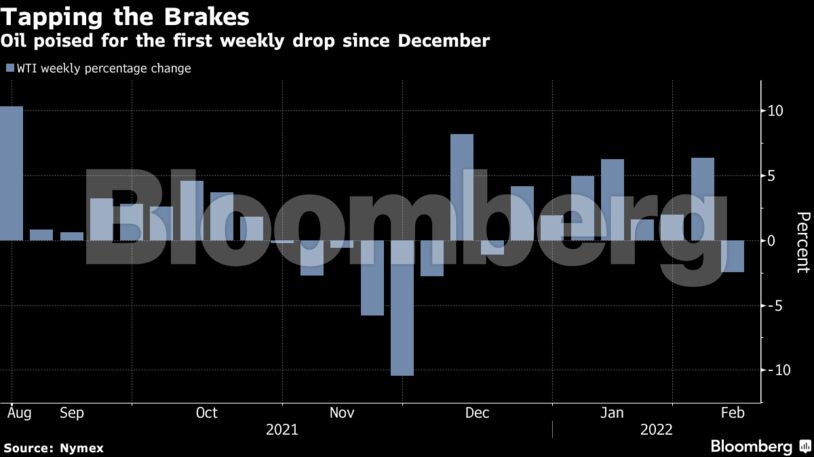

While futures in New York edged above $90 a barrel on Friday, they are still down about 2% this week. Officials from the U.S. to Europe have indicated that sides are closing in on a nuclear pact after talks resumed in Vienna on Tuesday. A bigger-than-expected jump in U.S. inflation that stirred hawkish Federal Reserve comments added to the bearish sentiment.

“There are positive signals coming out of the Iran nuclear negotiations that suggest the finish line could be in sight, but as always, the devil is in the details,” the Paris-based International Energy Agency said in its monthly report on Friday.

Although oil’s scorching rally has taken a breather, global consumption continues to rebound, with OPEC suggesting Thursday that the recovery could surpass its forecasts this year. The IEA also said that prices may climb further because of the OPEC+ coalition’s “chronic” struggle to revive output, unless the group’s Middle Eastern heavyweights pump more.

Rising energy prices are causing concern for governments worldwide. White House Economic Adviser Jared Bernstein told CNN this week that releasing more crude reserves to tackle surging gasoline prices was an option, while the soaring cost of diesel is straining truck operators throughout Asia.

| Prices |

|---|

|

The resumption of a nuclear accord with Iran could help alleviate some of the tightness in the global supply-demand balance. White House Press Secretary Jen Psaki said a deal that addresses the concerns of all sides was in sight, while European Union foreign policy chief Josep Borrell said parties were “reaching the last steps.”

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS