Futures in London lost 0.8% after earlier touching $94 a barrel. Marathon Petroleum Corp.’s 593,000 barrel-a-day Galveston Bay refinery in Texas was shut after cold weather. Oil product markets surged after the news, with heating oil margins climbing to their strongest since April 2020, while crude’s structure cooled.

Traders also continue to watch the Iran nuclear deal negotiations, with diplomats set to return to Vienna Tuesday. On Friday, the U.S. signed several sanctions waivers related to Iran’s civilian nuclear activities, though Tehran said it still needs guarantees from Washington in order to revive the deal.

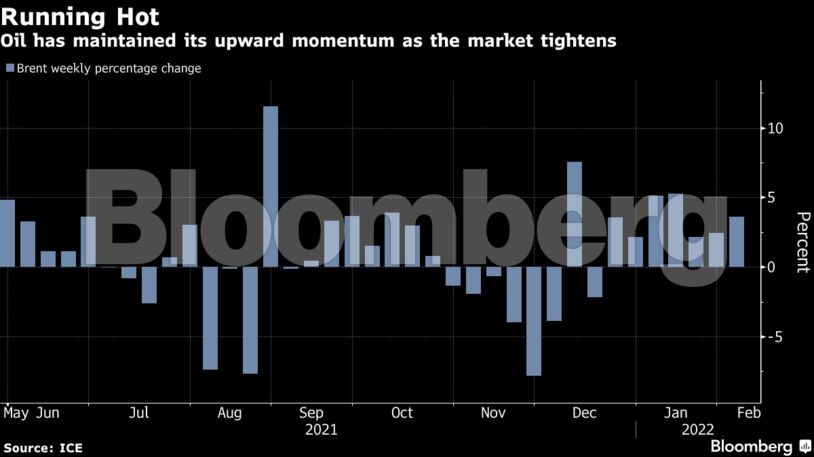

Though crude has begun the week on the back foot, the oil market’s structure has been indicating one of the strongest supply-demand balances in years. That has come as the average price of gasoline in the U.S. rose to the highest level in more than seven years and calls for $100 a barrel by some of Wall Street’s biggest names grow louder.

“Crude oil trades lower, led by WTI,” said Ole Hansen, head of commodities research at Saxo Bank. “The potential for an Iran nuclear deal is higher than for a long time.”

| Prices |

|---|

|

Over the weekend, Saudi Arabia raised oil prices for its customers in Asia, the U.S. and Europe. The hike of 60 cents to its key Arab Light grade to Asia was largely in line with trader expectations.

OPEC+ last week agreed to boost output by 400,000 barrels a day in March, but the group is struggling to fulfill its supply pledges. One of Libya’s biggest oil companies was recently forced to cut output due to a lack of storage capacity caused by the inability to perform maintenance on tanks.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

Trump Is Scaring Republicans Away From Saving the Planet